Blooom Review – Excelling in Retirement

Retirement: that golden age of life where you do whatever you want, whenever you want.

Well, within reason, of course.

But you can’t just sit around for 40 years and expect to have all your financial needs taken care of.

Quite the contrary: successfully retiring involves decades of diligent saving and investing.

However, there seems to be almost as many retirement investment vehicles as there are dollars you need to invest.

And navigating the complicated world of investing involves many hours of reading news and educational material, not to mention managing your investments and tracking your progress towards that light at the end of the workforce tunnel.

Fortunately, the investing world is becoming increasingly “democratized” (aka accessible to the average person) due to the proliferation of investment apps and robo-advisors. Many apps are generic, but some are tailored to specific needs such as

- Simple but comprehensive budgeting (think Mint)

- Saving for a house

- Paying for college

- Investing your spare change (like Acorns)

But since we’re here to talk retirement, we thought we’d show you Blooom, a robo-advisor app tailored to helping you retire.

Before we show you the strengths and weaknesses of Blooom, we’d like to reiterate the importance of saving for retirement beginning your saving early.

The Importance Of Saving For Retirement

Saving for retirement is critical if you want to enjoy your freedom from the workforce during the latter half of your life.

After all, your expenses don’t stop just because you’re “unemployed” status is legally and culturally sanctioned.

Some might point out that it is possible to neglect saving a lot for retirement and still get by. That’s great advice… if you want to move back in with your children, survive on welfare, or live out your years in a retirement home.

If you want to live a halfway-decent retirement lifestyle, you need to establish some savings as well as some retirement income streams.

If you want to live a lavish lifestyle, however, you’ll have to work even harder (and save for a longer time) to maximize your retirement fun.

Save Early, Save Often

In theory, you don’t need to start saving for retirement from your very first paycheck. You could wait a few years and blow your potential retirement savings on other things and still come up with enough cash at age 65 to live on.

However, every year that you aren’t saving for retirement sets you back A LOT.

First of all, you can’t get time back. If you didn’t put $1,000 aside for retirement last year and spend it on something else, you’re permanently down $1,000. You could put double in this year to compensate, but that’ll hurt your finances more in the present.

But that’s not the only reason to start early.

Now, you’ve probably heard of compounding, right?

Investing early for retirement allows you to take full advantage of compounding.

See, the earlier you invest, the more time your money will have to work FOR you and make you more money in the form of interest/other returns on investment.

To illustrate just how significant this can be to your finances, let’s run a quick thought experiment.

Say you started investing the moment you walked into your first day at your first 9-5. Let’s assume you’re 22 at this time and you invest a constant $5,000 per year in a tax-deferred account that yields 7% returns until you turn 32. Once you hit 32, you stop contributing to the account.

Assuming nothing changes, your account will have grown to about $690,000 by age 65 even though you haven’t touched the account in 33 years.

Now, let’s say you wait one single year longer and start investing at age 23. Assuming all other thought experiment data stays the same, you’ll have around $644,000 in your retirement account.

Beginning your retirement savings journey just one year earlier in this case will earn you the equivalent of a big-city, entry-level salary.

The difference only gets wider the later you invest!

Now that you understand the importance of saving/investing early, let’s talk about how Blooom makes this easier.

What Is Blooom?

Blooom is the name of the company that created their eponymous retirement investing app.

But we’re here to talk about the app, so let’s do that.

The Blooom app was created to make retirement investing easier, with emphasis on employer-sponsored retirement plans such as the 401(k).

If you don’t know what 401(k) plans are, they’re a very common pretax retirement plan provided by employers. When you contribute, a financial management firm invests your money into funds specified by the plan to help you grow your retirement funds. Usually, employers match your contributions up to a certain percentage (meaning they give you free money).

You can link other employer-sponsored plans [401(a), 403(b), 457 and TSP Plans as well. For simplicity’s sake, however, we’ll stick with 401(k)s.

Blooom’s goal is to simplify and cut the cost of money management so that those without extraordinary wealth can save enough to enjoy the retirement lifestyle they’ve always dreamed of.

The app analyzes all investment options in your 401(k) and throws out the ones that don’t make sense based on your retirement goals.

It then picks investments for your approval based on your current age and your expected retirement age.

Blooom prides itself on being the “affordable online 401(k) management for the 99%”, yet another nod to the democratization of investing.

Part of their Manifesto (which you can access on their site) even details how one of the founders was disillusioned with serving only those with plenty of wealth to invest and wanted to help the common person better manage their retirement investments.

Here is a video from Blooom themselves!

So what do they do to follow through on such a noble goal?

Blooom’s Strengths

The 401(k) Focus

Many apps place themselves in the retirement niche, which is pretty helpful for retirees.

But Blooom takes it even further by heavily emphasizing the 401(k) plan.

Why is this such a big deal?

First of all, the total amount of assets in all 401(k)s was estimated to total over $5 trillion at the end of 2018, according to the Investment Company Institute.

And although data on the number of 401(k) participants is somewhat elusive, you can logically conclude that $5 trillion of 401(k)s means a significant portion of the workforce has one.

Yet for some reason, robo-advisors rarely offer 401(k) management; they’d rather handle money from more well-off people.

With little support from robo-advisors, managing your 401(k) could be a headache.

Blooom’s emphasis on 401(k) management is therefore a boon for many Americans who are looking to maximize their retirement savings.

Blooom lets you manage your 401(k) plan no matter where you work or who manages your plan, so no need to worry about being unable to use it.

Absolutely No Account Minimum

We already went over the importance of saving for retirement as early as possible to take full advantage of compounding.

But it’s hard to do that when you’re required to have a significant amount of money to start.

That’s why Blooom doesn’t require you to have ANYTHING in your 401(k) to start using the app. As soon as you open your 401(k), link it to Blooom and start using it to maximize your investments.

Support From Real Financial Advisors

Got questions about financial planning that Google can’t answer?

Blooom offers support from real-life financial advisors for a variety of financial planning issues beyond just 401(k) management.

You can reach these advisors via email, text message, and in-app chatting. They’ll help you answer plenty of financial planning questions, including but not limited to

- Budgeting

- Major purchases (houses, cars)

- Other retirement investment options

- Miscellaneous investment questions

They’re free to use with the app, so use them liberally!

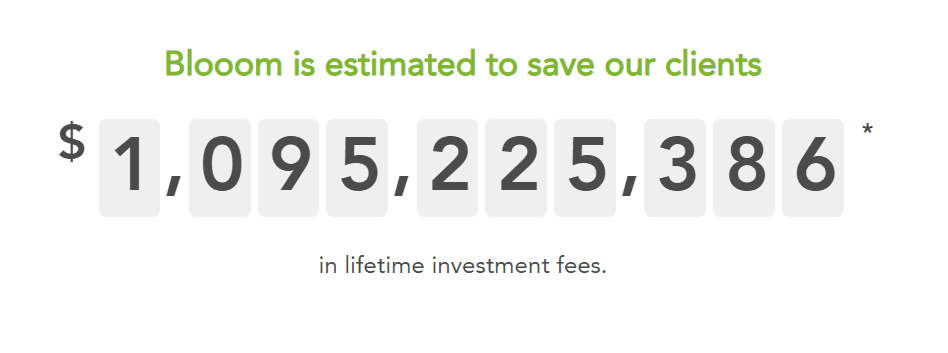

Pricing

Blooom has a simple and affordable pricing structure with a decreasing rate based on your account balance. Here’s how it works:

- $2,000 – 6% per year

- $10,000 – 1.2% per year

- $25,000 – 0.48% per year

- $50,000 – 0.24% per year

- $100,000 – 0.12% per year

6% of $2,000 is $120/year; that sounds like a fair chunk of change, but it comes out to only $10 per month. That’s around what you pay for Netflix, except this helps you save for retirement.

That’s not too bad, given this is one of the only apps that offers such a niche personal finance service. They could jack up the rates a bit more if they wanted, but it seems the founders of Blooom want to stick to their mission despite room for more profits.

Good on them!

To get rates that beat other robo-advisors (who’s rates typically fall between 0.25% and 0.50%), you’ll need to get up to that $50,000 mark; it’ll take you a long time, but if you keep contributing up to the matching amount as your salary grows, you’ll get there before you know it.

The “Glide Path”

One piece of common investment advice goes like this:

Invest in riskier (within reason) assets when you’re young, as you have more time to recoup losses AND your returns will supposedly average out over time.

As you get older, you’re told to pull out of riskier assets and invest in something safer, like bonds.

In other words: be aggressive when you’re young, and conservative when you’re old.

Blooom does this automatically using an “exponential glide path” that relocates your assets based on your age and retirement age.

Pretty nifty.

Blooom’s Weaknesses

The 401(k) Emphasis…

What Blooom excels at is 401(k)s; unfortunately, that comes at the expense of extremely limited offerings.

In fact, 401(k)s are the only retirement account Blooom manages at all!

Perhaps they’ll expand their offerings in the future; for now, you’re out of luck if you have anything other than a 401(k).

Analysis Isn’t As Rigorous As It Could Be

Because Blooom is focused on helping people retire, their focus is on, well, retirement.

Such a narrow focus means you might not get as thorough or accurate of a risk tolerance assessment as other robo-advisors.

Signing up and answering the questions is a quick and simple process, it just simply isn’t as rigorous as many would like it to be.

They Don’t Have Phones

You can reach Blooom through chatting or emailing, but they have no customer support number to call.

If you prefer to speak to someone rather than chat online or over email, there isn’t much you can do as far as Blooom goes.

Who Should Use Blooom?

Blooom’s primary demographic is that huge slice of workers that make enough to fund a 401(k) (or other employer-sponsored plan) and a few other simple investments, but not much else.

This demographic has been historically underserved when it comes to financial management, which is unfortunate given the massive amount of people in said demographic.

If you’re one of these people, you should look into using Blooom if you want to both simplify your retirement investing and maximize returns on your 401(k) or other employer-sponsored plan.

However, if your retirement portfolio is spread among multiple retirement accounts (such as traditional or Roth IRAs), another more complex robo-advisor (or real financial advisor) might be right for you.

Whether you fall in love with Blooom or choose a different investment management service, one thing remains constant in the “saving for retirement” arena.

Save early, and save often.

You’ll thank yourself in a few short decades when you’re living your dream retirement lifestyle.