Banking is a great way to keep your money safe.

It’s much harder to lose your money to robbery or natural disaster when it’s behind an almost impregnable safe (not to mention all the other security measures).

But most banks pose another threat to your money.

That threat?

Fees!

Most banks nickel and dime you on the smallest things.

No point in getting excited about a tiny bit of interest if it’s taken right back in the form of bank fees.

But fortunately, newer online banks have rushed in to serve those who hate fees.

One of these banks is Chime Bank.

They are 100% online and fee-free.

Before I tell you more, however, it’s time to shine a light on just how much you could be losing to bank fees.

Types Of Fees

Banks seem to have a fee for everything. Let’s take a look at the most common fees that slowly drain your bank account.

Maintenance Fees

Perhaps the most common fee in relation to bank accounts is the maintenance fee.

To avoid this fee, you have to fulfill certain requirements that differ based on which account you have.

Typically, the main requirement is a minimum balance requirement.

Dip below that requirement, and your bank could be taking money out of that account every month.

Overdraft Fees

Ok, it is your responsibility to ensure your account has sufficient funds to cover any spending or withdrawals.

But some of those overdraft fees are quite hefty.

Just imagine paying $30 because you accidentally ran out of money in your checking account.

Now you’re $30 MORE in the red.

How inconvenient – and not to mention kicking you when you’re down!

Early Account Closure Fee

Feeling some buyer’s remorse after opening a new bank account?

Don’t close the account right away; many banks try to rope in customers with early account closure fees.

Yes, that’s right.

If you want your money back from the bank after an insufficient amount of time, they’ll charge you for it.

But what’s considered “insufficient”?

Some banks will charge you if you close your new account within 6 months of opening it.

That doesn’t seem very fair…

Returned Deposit Fees

What’s worse than paying to access your money (aka ATM fees)?

Paying to deposit your money!

Some banks will charge returned deposit fees if a deposit doesn’t go through. This most commonly takes the form of a bounced check.

Smaller banks usually don’t charge these fees, but many big banks will.

It’s infuriating to attempt to deposit money and be charged for it.

There are plenty of other fees banks charge you that aren’t as common, but you’re probably tired of reading about ways banks take your hard-earned cash.

On that note, let’s talk about if you should ditch your old bank and start banking with Chime.

First, The Pros

Chime claims they want to change the way people feel about banking.

But how are they doing so?

No Fees

Let’s start with the obvious.

Chime Bank boldly proclaims their “No Hidden Fees” policy.

And they adhere pretty well to that policy.

Aside from plainly spelling out the 4 easily avoidable fees they do charge, you’ll quickly discover that there aren’t any overdraft fees, no regular maintenance fees, and no minimum balance.

If you want to stick $1 into a Chime checking account, go for it!

Another less common yet still frustrating fee you won’t find with Chime is the foreign transaction fee.

Most of the time, you’re in your home country and therefore don’t need to worry about this fee.

But it’s easy to forget to exchange currencies (or get enough of the foreign currency) when you’re traveling.

This leaves you with your credit and/or debit card(s).

Most banks would tack on a small fee to every purchase you make with your card. This can add up to a noticeable amount of money if you’re traveling long enough.

But with Chime, you don’t even need to think about exchanging currency since they won’t charge you foreign transaction fees!

Payday Comes Early

Many traditional banks wait a bit before giving you access to your paycheck.

This can be a pain if you have an urgent bill to pay off.

But Chime wants your money to reach your hands as soon as it’s available.

Instead of holding on to your paycheck for a day or two like many banks do, you’ll get your money up to two days earlier than other banks!

That’s because Chime gets to processing your paycheck as soon as it comes across their desk.

Make sure to set your direct deposit to Chime if you do any banking with them.

Yes, They Have ATMs

You’re probably worried that a 100% mobile bank like Chime has no ATMs, making it difficult to withdraw cash.

Well, I’m happy to announce (and you should be too) that you’re wrong in this case!

When banking with Chime, you gain access to 38,000 ATMs from MoneyPass and Visa Plus Alliance.

And remember how Chime bank touts it’s fee-freedom?

These ATMs are fee-free as well!

Chime really follows through on their promises.

Automatic Savings

If you’ve read my post about some financial goals to set for yourself in 2019, then you’d know of a little app called Acorns.

Acorns is an investing app that uses the concept of “roundups” to make investing easier by taking your “spare change” from purchases and investing it into your Acorns portfolio.

Well, Chime’s savings account has a similar function.

Here’s how it works:

First, you have to make a purchase with your Chime card.

To illustrate this function more clearly, picture this:

Imagine you just spent $30.46 filling your car up at the gas station.

Chime will automatically take the “extra” $0.54 and put it into your Chime savings account.

It’s a nifty feature because you’re never going to miss that $0.54, but after enough purchases, you could end up with a decent chunk of extra change in your savings.

Such a feature is a great way to pad your emergency fund without having to think too hard.

But hold on. The automatic savings features don’t stop there.

You know how employers like to match your 401(k) contributions with their own money?

Well, Chime does something similar with your savings account.

For every dollar you save, Chime adds 10% to that amount. They’ll reward you with free money for up to $500 extra a year!

Also, for you super savers out there, Chime lets you arrange an automatic transfer of 10% of each paycheck if you’re especially eager to save.

For many, all it takes to successfully save is to take out the “thinking about it” portion. If you don’t have to actually do the savings transfer yourself, you’re much more likely to adhere to a savings plan.

Not to mention that you free up some time and energy for other things.

Technologically Progressive

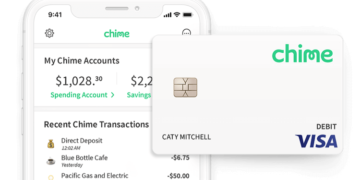

As a bank with no branches, Chime is almost forced to stay ahead of the pack technologically if they want a competitive edge.

That only means good things for you, the consumer.

Chime has poured time, money, and effort into making their mobile and online banking experience as convenient and helpful as possible.

In particular, their app is very intuitive and makes managing your money easy.

First of all, it’s very quick and responsive. Slow banking apps can make your already dreaded banking time even more of a headache, so it’s fantastic that Chime works so hard to make their app easy to use.

As for the app’s features, they all add to the standout convenience Chime provides you.

On one screen, Chime gives you a few things:

- A snapshot of your account balances

- Connected accounts

- The ability to link more accounts

- Shortcuts to various other features

Some of those shortcuts really add to Chime’s convenience. It’s very easy to set up a direct deposit, open a new account, and find an ATM.

On another screen, Chime lets you move money between accounts without jumping through a bunch of hoops. This is yet another factor that makes Chime a convenient bank.

Lastly, what they lack in face-to-face customer service, they greatly make up for in online support.

If you run into any issues, you can chat with customer service via the app or online and they’ll help you solve your banking problems.

Second, The Cons

Since it is a fee-free, 100% online bank, Chime seems like a very appealing choice of bank,

However, it’s important to notes it’s drawbacks. Here are some of them.

Low Interest Rates

Typically, banks that offer heightened levels of service in one area tend to lack in another area.

For Chime, their main detractor is their interest rates.

They’re checking account (or their “spending” account as they call it) has no interest rate.

That’s not too uncommon; most checking accounts don’t pay interest.

But their savings account barely pays interest at all either.

In fact, Chime’s savings account pays you a whopping 0.01% APY.

So if you put $100,000 into your Chime savings account, you’d earn an amazing $10 on your money.

At that rate, you may as well be earning no interest at all!

Such a small interest rate is the price you pay for the convenience of never paying annoying fees, though, so it’s not all that bad.

Difficult Deposits

As a bank with no branches, depositing cash can come with its challenges.

Sure, they have mobile deposit capabilities and these capabilities become better as mobile technology advances.

However, technology doesn’t always work how we want it to.

If your mobile deposit is being finicky, you’ll have to go out of you way to visit a Green Dot ATM.

You may be charged a fee at these ATMs, which is unfortunate since that’s probably one of the reasons you originally decided to try Chime in the first place.

Traditional banks with branches easily beat Chime in this area, since you can speak face-to-face to a human being for maximum banking ease.

No Overdraft

You might be asking yourself “How is no overdraft a bad thing?”

Well, there’s no overdraft fees. That’s all well and good.

But that means the bank can decline your purchases if you don’t have sufficient funds.

Barring instances where a purchase is critical, Chime won’t let you spend an amount greater than what’s sitting in your “spending” account.

Sometimes, it’s worth it to overdraw your account if you won’t be severely hurt financially.

Unfortunately, you can’t do so with Chime.

Big Checks, Little Trouble

For some reason, Chime limits your transactions via check to $5,000 per check.

Now, most people don’t spend $5,000 on a daily basis.

But this can make irregular expenses like deposits, large gifts, down payments, and other uncommon expenditures a hassle.

Fortunately, Chime doesn’t limit the amount of checks you can send per day.

So if you really wanted to gift someone $5,001, you can send two checks that sum to that amount.

But for other large lump-sum payments, it’s hard to pay in full from your Chime bank account.

The Verdict On Chime Bank

Mobile and online banking is revolutionizing how we manage our money.

Things like

- No fees

- Mobile deposits

- 24/7 account access

And other conveniences are making it easier for people to bank on their time.

Chime Bank is one of the fastest growing 100% online banks, and for good reason.

With no fees, early payday, and plentiful ATM access, Chime is a convenient banking option.

Sure, Chime has its flaws; but what bank doesn’t?

We think the minor issues with checks and overdraw are easily made up for by it’s fee structure (or lack thereof) and convenience.

Consider opening an account with Chime if you’re sick of being nickel and dimed!