Why Your Credit Score Range Matters In Everyday Life

Like it or not, our economy runs heavily on debt and credit.

Think about it: how many times have you bought a car outright? How about a house?

Unless you’re a multi-millionaire or you’re buying a junker car, you’re probably taking out debt of some sort to finance large purchases like those.

It’s important to have a thorough understanding of the FICO credit score.

Now, you probably already know that a credit score is a number that measures your creditworthiness (aka how risky it is for lenders to lend you money).

But it’s not enough to just know the basics.

We’re talking

- Who calculates it

- What affects it

- How it’s calculated

- How to improve it

So today, we’ll answer some of your burning credit score questions.

The 5 Credit Score Ranges

Credit score is measured on a scale from 300-850. It’s calculated by the 3 credit bureaus (Experian, Equifax, and TransUnion).

They all calculate it the same, but might have slightly different information regarding your credit history; this leads to the small score discrepancy you’ll notice between bureaus.

Moving on…

To make things easier for all parties, the FICO credit score scale is divided into 5 ranges:

- Very poor

- Fair

- Good

- Very Good

- Exceptional

Very Poor

At the low end of the credit score spectrum is the “Very Poor” range.

You’ll fall into this range if you’re unfortunate enough to have a credit score between 300 and 579.

Existing in the Very Poor range is like credit hell; you’ll learn why later.

For now, just know that you never want your credit score to crash this far.

Fair

A slight step up from Very Poor credit lies the “Fair” category.

Individuals with a credit score between 580 and 669 are considered to have Fair credit.

This range isn’t much better than the Very Poor range; while it’s true that a credit score of 660 will be seen more favorably than a credit score of 590, you simply won’t reap many of the benefits of good credit if you’re in this range.

Good

Finally, a category that isn’t bad to be in!

Those with “Good” credit have a score somewhere between 670 and 739.

Good credit isn’t great, but it isn’t bad either. You won’t get the full range of opportunities those with good credit are blessed with, but you definitely won’t struggle.

Here, you’re actually right around average despite the misnomer.

In fact, the average American FICO credit score is 693, which is only 11.5 points below the average of this range’s extremes.

In other words, it’s much better to be here than to be wasting away in “Very Poor” or even “Fair” credit.

Very Good

Up in the “Very Good” category, you’ll start to notice some perks (again, we’ll talk about these later) that accompany your credit score.

In order to reach this category, you need to build your credit enough so that it falls between 740 and 799.

To be quite honest, you’ll experience most of a strong credit history’s benefits when your credit is considered “Very Good”.

However, there is one more category for the dedicated ; the ones who want to be given only the most prime credit opportunities…

Exceptional

Sitting at the pinnacle of credit score is the “Exceptional” range. Once your score hits 800, your credit will achieve the coveted “Exceptional” title.

It takes a lot of hard work, persistence, and patience to earn Exceptional credit.

After all, you need to prove to creditors that you’re among the very best when it comes to managing your debts.

For many, there are diminishing returns when trying to reach Exceptional credit. As we said, you’ll get a whole barrage of benefits for having “Very Good” credit.

But if you have the gall, working towards Exceptional credit might be worth the effort.

Why Improve Your Credit Score?

Alright, it’s finally time to tell you why you should bring that score up.

Optimal Interest Rates

The higher your credit score, the better interest rates you’ll get on loans/credit cards.

Likewise if your credit score is low.

There’s two overlapping reasons for this:

- Dissuades bad borrowers – When your credit’s in the toilet, you’re considered “more risky” by creditors (whether you like it or not, unfortunately). Higher interest rates will turn off many of these “risky” borrowers, minimizing risk to the creditor.

- Helps cover potential losses – For those bad-credit borrowers that bite the bullet and take on new debt with a high interest rate. Creditors hedge against potential payment failure/defaulting on the borrower’s end by charging more interest.

If you don’t want outrageous interest rates every time you take out a loan or get a new credit card, it’s critical that you build your credit score.

Higher Approval Chances

In a similar vein to the interest rate aspect, a higher credit score increases your approval chances for new debt.

In the creditor’s eyes, a higher credit score means you’re much more likely to use the new debt responsibly.

You are quite literally more “creditworthy” when your score is high.

Rental Housing

Creditors aren’t the only ones interested in your financial habits.

A strong credit score can help you land your dream apartment!

It’s simple: like creditors, landlords want to know that you won’t skimp on rent/utility payments.

High credit scores again imply you’re financially responsible and won’t have a $0 bank balance when rent is due.

Now, high credit score won’t make or break the apartment hunting process…

But a low credit score will definitely make it a lot harder!

Jobs?

Believe it or not, your credit score even affects your job search!

But wait.

You might be thinking “why is it an employer’s business what my credit score is?”

And for some industries, you’d be justified in think that.

However, there are many industries that handle sensitive data or large amounts of money (and often both).

Employers in these industries check your credit partially to make sure you’re a responsible individual since you could be in charge of a lot of private information.

After all, employers that work with sensitive data need to take every possible precaution to make sure their new hires won’t screw anything up.

But there’s other reasons, too.

Bad credit could imply financial distress, and a financially distressed employee is incentivized to commit fraud.

Many jobs that check your credit are quite lucrative, making a high score all the more important.

How To Track Your Credit Score

Tracking your credit score is quite simple, and there are many options available. If you want to check your credit score and keep an eye on it, almost all of these methods allow you to check your credit score for free.

First of all, each credit bureau grants you one free credit report per year. Take advantage of this; get one each year and hold on to them in case you find any errors as errors can wrongly hurt your score!

However, many other services let you view your score as many times as you want.

For example, Credit Sesame is a free credit card reporting tool that will allow you to track your score for free and give you some helpful information on how you can personally improve your score.

There is also CreditKarma gives you your Equifax and TransUnion scores anytime you want, as many times as you want. Not to mention the millions of other great features and helpful content on their site.

The personal budgeting apps Mint and Personal Capital also shows your credit score. Sometimes, it takes a few minutes to update; however, it’s helpful to see your credit score next to all your other personal financial data.

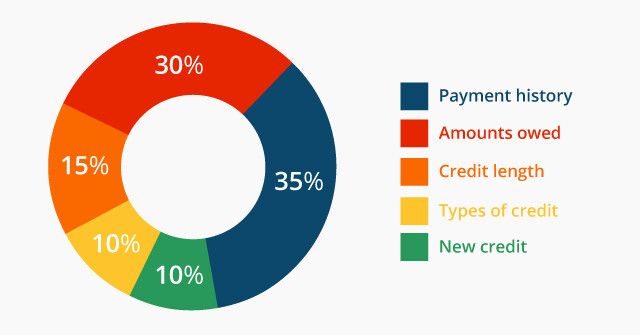

What Impacts Your Credit Score?

Before you can learn how to improve your credit score, you need to know what actually influences it.

There are 5 factors that impact your credit score; here they are in order from most significant to least significant impact:

- Payment history – 35% of your score. Fairly self-explanatory; your ability to pay bills/debt on time influences your credit score a significant amount.

- Credit utilization – 30% of your score. Credit bureaus look at how much of your total credit you’re using. They use something called the credit utilization ratio; this is calculated by dividing your total debt on credit cards/similar debt by your total credit limit.

- Credit history length – 15% of your score. Not as profound of an impact on your score, but still important. Ages of your oldest and newest credit accounts are factored in, as well as the average age of all your credit accounts.

- New credit applications – 10% of your score. Applying for new credit typically triggers a hard inquiry, meaning the creditor takes a formal look at your score and history. Hard inquiries slightly hurt your score.

- Credit mix – 10% of your score. The ability to juggle multiple kinds of debt without missing payments affects your score. Data also shows people with good credit mixes tend to be more financially responsible than people with only one type of credit.

How To Build Your Credit Score

Now that you know what affects your credit score, steps you can take to improve it will be a lot more intuitive.

If you would like a more exhaustive list, please check out our guide on how to improve your credit score here.

Pay What You Owe, And Do It On Time

You know how payment history is the biggest credit score factor?

One of the best things you can do is start paying every single bill on time.

No exceptions.

That means when your credit card bill comes around, don’t just make the minimum payment; pay off the entire statement (you don’t have to pay off the whole balance unless some portion is late, but more on that in a second).

Same with your loans. From here on out, make your monthly payment no later than the due date.

Your forgetful and/or lazy nature is no longer an excuse to miss payments with the existence of autopay.

Just set up autopay with all bills that offer the option, and you’ll putting your credit score-building efforts on autopilot.

Don’t Use Too Much Nor Too Little

Reducing your credit utilization ratio will give put some pep in your score’s step.

You don’t have to pay off ALL your debt (unless any of it is late), but work on reducing the total balance you carry on all your cards.

Not only will your credit score improve, but lower credit card balances result in your paying less interest if you owe it!

It’s helpful to maintain a small credit utilization ratio to reassure creditors that you DO use credit; it’ll show them you can manage some credit without it getting out of hand.

Wait It Out

Since credit history length is an important part of your score, one of the best things you can do is simply be patient.

Over time, your average account age will grow; new accounts might cause a credit score drop because of account age, but this effect fades as your portfolio of accounts grows.

Only Get New Credit When You Need It

Since hard inquiries hurt your score, it’s best to avoid them whenever possible.

So don’t apply for every credit card that presents itself to you; only take on debt when you absolutely need it.

As you build your credit history, these will have less noticeable effects.

Don’t Close Credit Accounts

There’s almost no benefit to closing a credit account. It doesn’t do anything to reduce the money you actually owe.

But keeping your accounts open can actually help your score for a few reasons.

First of all, credit utilization decreases if you have credit cards with very low balances. This will give your score an upwards nudge.

Also, your average account age will keep growing. If you close a long-time account, you might hurt your score too.

Lastly, keeping all your accounts open will ensure a solid credit mix. Once again, having a more diverse lineup of credit accounts is a good sign to creditors.

Stand Up For Yourself

We’ll leave with one more piece of advice to help your score: dispute any errors you see on your report.

These are hurting your score (and therefore negatively affecting your life) for no legitimate reason!

If you find any of these errors, take action ASAP.

Do it in tandem with our other credit score advice and your score is sure to climb to the top.