How To Make Money As An Airbnb Host

If you’ve ever traveled, you know that most hotels aren’t cheap. That is, if you want a hotel that isn’t a run-down looking building.

For what you pay at a hotel, you don’t seem to get much, either. Sure, the beds are nice and the TV is high-quality, but you get so little space.

And most hotel rooms look the exact same, so you don’t feel excited to explore the full capabilities of the room.

You’re not alone in this. Thousands of people, especially families with multiple kids, are sick of paying a huge premium for a cramped 2-bedroom space that doesn’t even have a kitchen.

They’ve turned to Airbnb as an alternative to the same old hotel room everyone’s become used to.

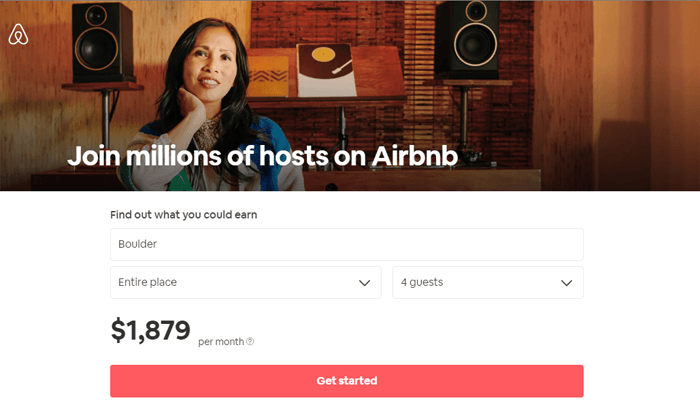

The best part is you can cash in on this trend as well! Creating an Airbnb listing is quite easy.

However, creating an Airbnb listing that makes you money is a little bit more difficult.

And so, we’ve created this ultimate guide to making money on Airbnb so you aren’t left to flounder around on the app for hours.

First, a bit about Airbnb.

Airbnb

Airbnb was founded in 2007 by 2 San Francisco roommates who simply could not afford the sky-high rent in their city. They threw down an air mattress, turned their loft into a bed and breakfast, and Airbnb was born.

Fun fact: Airbnb is short for AirBedandBreakfast for this exact reason. In fact, that’s what the founders called it for the first 2 years of its existence. It’s name was shortened to Airbnb in 2009.

They’ve now grown to annual revenues exceeding $2 billion, thanks to everyone who was getting sick of hotels AND others who wanted to be able to afford rent themselves.

Guests book rooms or entire residences from hosts, but the platform recently added “Experiences” which tell guests about nearby attractions and events.

What Are Airbnb Experiences?

Airbnb enhances the guest experience by allowing users to create their own travel activities for guests.

Experiences are unique because it extends travel activities beyond the same old museums and tours. As the host of an Experience, you can customize your experience activity however you want!

For example, perhaps you live in a popular locale known for it’s traditional dishes. You could set up an Airbnb Experience listing where you teach guests how to cook one or more of these traditional dishes.

Or maybe you know the terrain and local wildlife around you quite well. You might create an experience that takes guests to cool hidden spots out in nature where you can teach them more about local wildlife.

Essentially, you offer your unique perspective on the local area and culture to create a unique, authentic experience for guests.

At the end of the article, we’ll tell you how to make profitable listings for both homes and events, in case you want to take a more active role in your Airbnb income.

Legalities And Formalities

In a perfect world, anybody could list their place on Airbnb and start making money right away. Given the apps intuitive interface and simple listing process, you’d think there’s nothing to worry about.

But remember, you’re making income off your property or rental residence so there are a bunch of legalities and formalities to take care of before you can get in on the Airbnb game.

Check The Law

The last thing you want to happen in your pursuit of an Airbnb income stream is to get on the law’s bad side.

Airbnb puts the responsibility solely on you as the host to comply with all local laws and regulations regarding housing and rentals. You can try to sneak under the radar, but we don’t advise nor do we condone it.

If you are found to be illegally renting out your place on Airbnb, the law won’t just kick your guests out. At best, guests will be allowed to finish their stay. Usually, though, the law and Airbnb makes you help them seek new accommodations or the guests just get forced into a hotel.

Then, you’ll be fined (or whatever other punishment occurs in your locale) and hit with bad reviews, and Airbnb may even take action against your account.

You might think that law shouldn’t care about Airbnb rentals, but that’s the unfortunate reality of the situation.

Now, some cities don’t let you rent out your place at all. However, many other cities offer licenses or permits to allow you to rent to guests short-term.

Whatever it may be where you live, make sure to review all local laws thoroughly before renting your place out on Airbnb. It’ll save you a lot of headache, money, and bad Airbnb ratings.

Check With Your Landlord

A lot of landlords put clauses in their leases that very clearly lay out their exact policies on additional guests or residents that aren’t on the lease.

They do this for many reasons:

- Safety

- The law

- Maximizing the income on their property

If you live in a rental, someone else owns that place. Naturally, it’s a bit unfair if you’re making money off someone staying there rather than the property owner.

Make sure to read through your lease and see if they mention anything about subletting/additional tenants. They most likely do.

Whether or not you see anything, speak with your landlord about the matter first.

Remember: they’re people too. If you’ve built rapport with them over your time at their property, they may be willing to let you list it on Airbnb if the law allows it.

Check With Your Neighbors

Legal and contractual issues are important to take care of before you list your home or apartment on Airbnb. However, you also have to be considerate of those around you.

Namely, your neighbors.

See, even if the law and your landlord (if you have one) agrees to let you list your place on Airbnb, that doesn’t mean your neighbors will like it. That’s fair.

If you don’t listen to your neighbors, they’ll grow to dislike you and may even find ways to take legal action if there are any. Again, you don’t want the law coming after you just because you’re trying to make some Airbnb money!

So if you have neighbors that don’t take kindly to rowdy college kids, for example, then you’ll be out of luck when spring break rolls around if you live in a popular beach town.

Of course, make sure to reiterate multiple times (in a tactful way) that you have neighbors and that your guests need to be considerate of them. This can be enough to keep most guests in line.

Usually, this means mandating quiet hours if your residence doesn’t have any. Try for something reasonable, like 11pm quiet hours. Your guests don’t have to be dead silent, but they have to basically stop partying and being loud so you don’t jeopardize your relationship with your neighbors.

Even if you own a house, you should probably enforce quiet hours too. Your neighbors might still be able to hear loud noises from buildings away.

Insurance

Airbnb hosts have a lot liability. Not only do are they risking their residence, but their guests could hurt themselves, others, or cause damage in other ways.

Insurance can mitigate the effects of bad guests.

Airbnb has insurance for home hosts and insurance for experience hosts.

Both types of insurance protect against 3rd party claims of personal injury and property damage up to $1 million.

Host insurance primarily covers 3rd part claims of property damage or bodily injury resulting from your property. It also covers some property damage in nearby common areas, such as an apartment lobby.

Host insurance will even cover certain claims filed against your landlord or homeowners association if the guest causes property damage or suffers an injury.

Airbnb gets their experience insurance from multiple providers based on country or region. It may cover slightly different things, but they tend to be the same as what host insurance covers.

For example, if you’re taking your guests on a nature hike and a guest trips and breaks a wrist, your experience insurance will provide you coverage if they file a claim against you.

Neither type of insurance covers any action that was done intentionally. So if you have guests that imbibe a bit too heavily and they decide it’s a good idea to knock stuff over, you aren’t getting covered by either host or experience insurance since they did that on purpose

Neither type of insurance covers property damage arising from mold or pollution either. It’s not Airbnb’s job to pay you damages unless the guests themselves did something. If you simply aren’t taking care of the place, Airbnb makes it clear it’s not their responsibility.

Airbnb seems to dislike airplanes, as their insurance doesn’t cover any experiences that involve them. That’s most likely because airplanes are risky and Airbnb’s insurance providers charged too high of a rate for those types of experiences.

If you do want further coverage from the outside, don’t rely on your homeowner’s insurance. That homeowner’s insurance assumes YOU (the homeowner) are using it. Your provider may terminate your policy and refuse to service claims if they find you’re listing the home on Airbnb.

Instead, you’ll need vacation rental insurance if you’re seeking additional coverage. This type of insurance is built specifically for things like Airbnb.

A good vacation rental insurance policy should have both liability coverage for the guests and coverage for the building and everything inside the building.

Taxes

Uncle Sam won’t be looking the other way just because you’re making an income off your own home.

You’ll have to pay taxes on your Airbnb income if you make enough. The first step to minimizing these taxes is giving Airbnb your W9 information so you’re taxed at the right rate. If you fail to do so, they’ll tax you at the full 28% rental rate.

Once you’re rolling, it’s not as easy as getting a W2 at the end of the year. After all, you have no boss in Airbnb.

Technically, you could just rely on bank statements. However, that takes many more hours than simply making a new Excel entry or letting your income flow through automatically to Quickbooks.

Documenting all your income is a much better idea.

You’ll want to document every piece of income, even if Airbnb does it for you. Keep a detailed spreadsheet or sign up for bookkeeping software like Quickbooks Self-Employed so you have accurate record of your earnings.

It’s not all bad news, though: with taxable income comes tax deductions. You may be able to take certain expenses as business deduction.

It’d be wise to speak with an accountant to maximize these tax deductions and minimize the government’s share of your income. In the meantime, you should continue to track every single detail regarding your business just in case the IRS ever comes knocking.

Federal, state, and local income taxes aren’t the only types of taxes to be aware of when making money on Airbnb.

Various states and cities impose steep short-term rental taxes on Airbnb users. For example, New Jersey collects an 11.6% tax! Massachusetts is another short-term rental taxer, weighing in at 5.7% on short-term rentals.

Taxes are generally passed on to the guest, making the listing appear more expensive when they go to check out. There’s not much you can do about these high taxes except let your guest know why they’re paying extra.

If you’re open and honest, you’ll have a more positive hosting experience.

What It Takes To Be A Successful Airbnb Host

Airbnb is an amazing way to earn some side cash off your residence, but that doesn’t mean you can just list and forget.

There a numerous factors to get right before your residence can start paying you on autopilot.

Targeting The Right Market

The most crucial question to ask yourself in any business is “who is my target market?”

You can’t please everybody in life, and that same concept applies to picking who you’re selling to.

Think of it like this: target the whole world, and your product (or listing in this case) doesn’t check enough boxes for anyone.

But the more you zoom in on a target market, the more of their “boxes” you can check, meaning more buyers.

You’ll get a smaller target market, but a higher percentage of buyers from that market.

Taken to its logical extreme for example’s sake, you could theoretically target one individual by promising them everything and guaranteeing 100% of 1 sale.

Of course, you want to be somewhere in the middle.

Anyways, there a many types of people you could target.

For example, maybe you live in a high rise apartment. You’d could target business travelers that want an alternative to hotels, or maybe wealthy young people looking to live it up in the city on vacation.

Or perhaps you live on in Miami Beach. During the spring and summer, your target market is pretty much all college kids.

Take a look at your residence and the surrounding area. It’ll help you determine what kind of guest would love to stay at your residence, thus helping you identify a good target market.

Time Commitment

Truthfully, there’s no such thing as 100% passive income. Any income stream you build will require some level of work, even if it’s as little as 5 minutes per week; Airbnb is no different.

Most obvious is the upkeep and cleaning of your place.

You can demand that guests clean everything up before they leave, but you’re relying mostly on their word. Plus, unless your guests are selfless givers, they won’t clean anything if they can justify that they didn’t cause it.

And so, you’ll dedicate a lot of time to cleaning up after guests. This means vacuuming, dusting, rearranging stuff, and picking up any trash left behind.

But there are other tasks that’ll drain you of your time if you aren’t careful.

For example, guests might be running late on occasion. That means you’ll have to wait in your place until they get there, further delaying whatever plans you had that day or for traveling if that’s what you’re doing.

To avoid waiting for late guests, you could leave your key hidden somewhere outside your dwelling. It’s a risky move, though, so it’s up to you to decide if you want to risk your key. We don’t advise it.

Overall, you should budget about 2-3 hours max a few days a week keeping your property in good shape, as well as managing listings. On days where guests are arriving or leaving, you could spend up to an entire 8 hours to ensure everything goes smoothly.

Some issues that might increase your time commitment include

- Check ins and check outs – Even though they don’t take long, check in and check out procedures add up. And when guests are late or have issues finding the place, that’s more time down the drain.

- Random other issues – Sometimes, you may be called in to take care of something else related to your Airbnb listing. Maybe guests are being too noisy or they broke something. Or perhaps your guests lost their keys and need new ones.

Of course, your time commitment increases with the space you rent out. If you’re listing a guest bedroom, your time commitment will be much less than if you listed a large house.

To reduce time commitment, follow these tips:

- Open communication – Regular communication with guests ensures you’re on top of everything that happens. Especially useful for check-ins and check-outs.

- Professional cleaners – They can save you a ton of time if you’re willing to spend money.

Account For Fees And Costs

Your Airbnb listing is going to cost you in the form of expenses.

Back on the topic of cleaning, you’ll either have to a professional cleaner or buy the supplies and do it yourself.

A good host provides clean sheets, towels, and similar items, so don’t forget those.

Utilities should be factored in too. You’ll have to pay for the utilities your guests use.

Airbnb unfortunately charges a processing fee of 3% as well.

Make sure to work these into your budget.

How To Sign Up To Host On Airbnb

Signing up on Airbnb is free, easy, and only takes a minute. You do have to be at least 18 years old, which makes sense.

Step 1: Create An Account

Head over to Airbnb.com and click Sign Up. You can then sign up using your email address, Facebook account, or Google account.

Step 2: Complete Your Account

Airbnb requires all users regardless of whether they intent to host or be a guest to fill out some basic information.

The information you need to give them includes

- Full name

- Email address

- Confirmed phone number

- Introductory message

- Agreement to house rules

- Payment information

Once you’ve completed this information, you officially have an Airbnb account. In addition, you should add a profile picture. It’s not necessary, but it puts a name to a face for all your guests as well as if you ever use Airbnb as a guest yourself.

Creating A Home Listing That Makes You Airbnb Income On Autopilot

Finally, the moment you’ve been waiting for. Here’s our step-by-step process to creating a near-passive income stream with your Airbnb listings.

Step 1: Create A Killer Profile

Before you make your listing, you want a complete profile. But your profile should also help you sell your listing to potential guests.

You can create a simple headline like “Hello! I’m *NAME*”.

The part that really sells you is the description. Write about yourself and your experience living in the area where your listing is located.

Try to convey traits like open-mindedness, ease to work with, and friendliness. After all, these are total strangers so the slightest indication you might have ill intentions will turn them right off your listing.

Like we said earlier, a professional or casual head shot works great for conveying sincereness and it gives your guests peace of mind.

Step 2: Creating Your Listing

Choose the type of home you have (apartment, house, bed&breakfast, other), room types, accommodation numbers, and your city.

Now, this part may be simple, but you still want to get everything right or you could attract the wrong kinds of guests (refer back to the target market section). For example, if you select “Entire Home/Apartment” as the room type, you’re implying guests have access to everything, even things like your garage.

Airbnb provides short descriptions if you’re unsure about your listing’s classification.

Step 3: Calendar And Pricing

Airbnb offers 3 types of calendar listing: “Always” for indefinite listings, “Sometimes” for specific dates and/or time periods, and “One Time” for one-off listings.

If your main home is in a spring break town, “Sometimes” might be a good idea.

“Always” works great if you’re renting out individual, unused rooms. People with summer homes might do that as well, then just take the listing down when they want to use their home.

“One Time” is good for everything else.

As for pricing, Airbnb suggest a price based on the info you provided them as well as market trends. You don’t have to take their price; however, we recommend undershooting their suggestion a bit to get your first guests.

However, try to factor in utilities and taxes as well. Striking a balance might be difficult, so don’t worry if you don’t cover everything.

Airbnb doesn’t let you include late check ins or other penalties, but you can communicate those on an individual basis with guests.

Step 4: Title and Overview

You title is your one chance to grab the reader’s eyeballs. Be descriptive of your location and try to emphasize any unique selling points.

As for your overview, this is what gets the guests excited.

Cover all the major selling points of your listing. Don’t be afraid to let some personality shine through; you are meeting new people, after all.

But what if your listing has drawbacks?

Time to “make the skeleton dance”, which means put a positive spin on the negatives.

This doesn’t mean lie about drawbacks. But being honest about them and portraying them positively goes a long way.

Avoid making the description cluttered; bullet points and short sentences are much easier to read than big walls of text.

Step 5: Photos

Good photography really drives it home for guests. If they can picture what the place looks like, they’ll be much more likely to book.

Your first 3 pictures should be the most interesting parts of your listing, as they’re seen first. After that, try to snap each room from 1 or 2 angles.

Get some picture of the area around the property as well. It gives some context to your listing so guests can mentally envision themselves there.

Step 6: Amenities and The Listing

Amenities are perhaps your main selling point if you don’t have a unique location. Airbnb has many different categories, from essential stuff like types of rooms to extras like hot tubs or pools.

Don’t hold back on the amenities. List every possible amenity you have and really flesh out the description. You never know if even the smallest amenity persuades someone to book your spot.

Amenities are also editable at any time.

Then there’s the listing itself. If you’ve done everything right so far, this should be mostly filled in. Check it over just in case.

Step 7: Location

Airbnb handles a lot of the location information for you. Just start typing your address and Airbnb will autocomplete your search results.

Once you pick your address, Airbnb will actually populate your listing with a notice of local property laws. In addition, they’ll give you a section to add directions so guests know how to get to your listing.

Finally, you’re ready to publish your listing and make some money!

Creating An Experience Listing That Makes You Airbnb Income On Autopilot

Creating an Experience listing that sells is largely the same as listing your property, but there are some key differences to consider.

First of all, they have to approve you.

They judge your Experience based on uniqueness (aka the guest would be hard-pressed to find a similar experience elsewhere), perspective (your experience must have personal meaning), and participation (guests actually participate in activities instead of watching you do them).

The legal issues might be different, so again, you’ll need to look into local laws to make sure you don’t do anything illegal.

You may need to seek out additional insurance, as Airbnb’s only covers certain things. Refer back to the insurance section of the article for more details.

Other than that, apply the same tips we gave you for property listings to your Experience and you’re bound to get some interested customers.

That’s It!

Now, you have the knowledge necessary to start making money on Airbnb.

If you work at it, you could create an income stream that covers your mortgage/rent payment on the property you’re listing!

But at the very least, you’ll have an additional income stream which is nothing to complain about.

Now get out there and kill it on Airbnb!