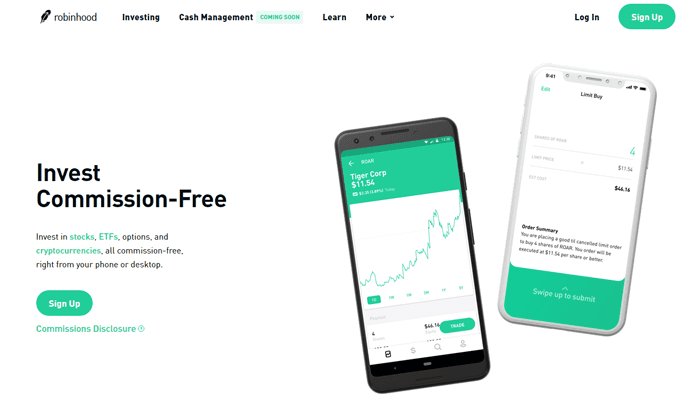

Robinhood App Review – Zero Cost Trading Platform

Back in the day, investing was much more difficult to do.

Back in the day, investing was much more difficult to do.

First of all, you needed plenty of money for both the investment and for your stock broker.

Sure, the invention of the internet meant you no longer had to call your stock broker every time you wanted to make a trade.

However, an internet connection wasn’t enough; there were still plenty of fees to pay to brokers and the process was more complex.

But now, there is a huge market of websites smartphone apps that have “democratized” investing, so to speak.

Robinhood is among the most renowned of these.

You’ve probably heard of it either from friends or advertisements.

Should you get in to the Robinhood game?

Let’s talk about it.

How Robinhood Works: Pros

No Fees, No Commissions

Robinhood prides itself on no fees.

Therefore, it’s an amazing platform if you want to invest and grow your money but you don’t want some broker taking some of that money with each transaction.

This helps encourage an historically underserved market: investors who trade often and with smaller amounts.

Referral Bonuses

Free money’s cool, but how does free stock sound?

That’s right: Robinhood took the hallowed referral bonus and reworked it so that you get a share of a random stock with every referral!

The stock is picked at random; most of the time, you’ll end up with a stock that’s only a few dollars per share.

But there are many people out there who were rewarded with stocks worth $100+ per share!

It doesn’t happen often, but the chance is there.

Oh, we almost forgot to mention: both Robinhood users win.

Robinhood gives both you AND your referring friend a free share when you use their link.

If you run a personal finance blog, this makes for an amazing source of affiliate income as your readers won’t complain about free stock.

Simplicity

There aren’t many other investing apps/sites nor general personal finance apps/sites with as intuitive of an interface as Robinhood.

The app has 3 screens:

- Investing (the main screen)

- Browse

- Account info

Scroll through the Investing screen, and you’ll see a dashboard of your stocks, a “watch-list” of hot stocks to keep an eye on, and even articles to keep you informed.

The Browse screen has even more news, as well as multiple ways to browse stocks.

In the last screen, there are multiple menus that provide you a ton of vital information. Some of these are

- Account summary – An overview of your portfolio/account balance, as well as important account statements and tax documents.

- History – A lengthy history of your transactions, including dividend payments

- Help – Not only can you reach out to Robinhood staff in this menu, but you can also access a few guides that Robinhood provides to help you get started

Robinhood is one of the few apps that packed so much good information into so few areas within the app.

How Robinhood Works: Cons

Lack of Customization

Robinhood may be intuitive, but that comes at the costs of customization options.

The Customer Service Is Lacking A Bit

If you need help with anything, you can’t call them. The only available help is their “Help” section and Google.

This means you’ll only be able to find answers to more general questions; if you have a hyper-specific issue, it might take a lot of Googling to solve.

How To Get Started On Robinhood

Getting started on Robinhood is simple.

First, find the signup link on their site or in their app and enter your basic information. Make sure you have an iOS or Android device, as you can only perform trades on your smartphone.

After entering your info and confirming you have the proper device, you’ll need to provide them identity information such as your Social Security number.

Finally, it’s time to fund your new account. Just link your bank to Robinhood and authorize a transfer.

Submit the application, download the smartphone app if you haven’t, and start trading!

Speaking of trading, we should talk a bit about the assets you can trade.

Stocks

Most of the assets on Robinhood are US-based equities. Some of the big names on here are Netflix, Tesla, Apple, and Facebook.

In addition to the US equities, there are around 250 stocks from outside the US.

ETFs

In addition to equities, Robinhood offers you a variety of Exchange-Traded Funds, otherwise known as ETFs.

ETFs are giant bundles of stocks and other securities that are sold as one asset and typically track an index. They’re lower-risk investments.

If you’d like a rundown of ETFs, check out this article we wrote.

Options

Tread with us into more complex investing waters for a second.

Options are a “derivative” security; all that means is the price of the option is based on the price of some other underlying asset.

To illustrate, one kind of option is known as a “Call”. Call options give you the right to buy some asset at a certain price within a certain time period.

An example of a “Call” option would be agreeing to buy 10 shares of X stock at $50 per share.

How does the buyer benefit?

Well, the buyer locked in a $50 share price. If the price increases to $70 per share, the buyer profits.

It’s like a more sophisticated form of betting.

Anyways, Robinhood does have options trading available for US-listed ETFs and stocks.

Paying For A Free App?

Anyone with a popular app or program has to monetize eventually, and Robinhood is no different.

However, they did it well.

Robinhood Gold is Robinhood’s premium plan.

For only $10, you can

- Trade when the market’s closed – Join institutional investors in trading before and after trading hours so you don’t have to waste time at work looking at your investments.

- Increase your buying power – Gold lets you trade “on the margin”, meaning you can borrow money from Robinhood to invest. Similar to a loan, there’s interest involved.

- Instant reinvesting and deposits – Rather than wait days for your stock sale proceeds to be available, Gold grants you instant access to them so you can reinvest for even more gains. In addition, Gold eliminates the 3 day waiting period for funds to transfer from your bank to Robinhood.

Due to your ability to margin trade, Robinhood unfortunately mandates you to maintain a $2,000 account balance with Gold as per financial regulations.

Robinhood Gold is for the slightly more serious investor who still enjoys simplicity in trading.

But if you don’t want to pay anything to invest, Robinhood’s free platform has everything the basic investor needs.

Robinhood Crypto Review

People and institutions of all kinds hopped on the cryptocurrency train after the Bitcoin explosion of late 2017.

Robinhood took advantage by creating a completely separate platform solely for crypto trading.

It’s been a huge boon for the crypto industry, which historically had a very complex aura around it.

Robinhood Crypto is extremely similar to Robinhood’s main platform, with the tradeable assets being the only big difference.

There are many different cryptocurrencies available on Robinhood Crypto:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

Robinhood is always trying to add other cryptocurrencies to the platform; check back every so often to see if there’s a new investment opportunity awaiting you.

Things To Consider

Day Trading Rules

Day Trading is exactly what it sounds like: buying and selling a stock within the same day.

The Financial Industry Regulatory Authority (FINRA) instituted the “pattern day trader” rule that is as follows:

If you’re a stock-trading investor that makes 4 or more day trades within a 5 day period, you’re considered a day trader and must maintain a $25,000 minimum balance in your trading account.

Why $25,000?

It’s to protect investors against risk.

But it also forces day traders to maintain enough money to cover “margin calls”, aka when people you’re borrowing from to margin trade ask for their money back.

There are plenty of ways to get around this rule, but they make day trading significantly more difficult and/or time consuming.

A Word Of Warning

Despite efforts by Robinhood and other companies to make investing friendly, there are still dangers involved.

If you’ve seen The Wolf Of Wallstreet or even just heard of Jordan Belfort, than you’re already imagining some sleazy salesman attempting to sell you on a “company with huge potential for growth”.

In all seriousness, stay away from penny stocks.

They aren’t transparent and shirk many of the regulations bigger stocks adhere to.

Not to mention the lack of liquidity (ability to sell off the stock) is low due to the lack of penny stock market participants. Once you’re in, it can be hard to get out.

Remember: if it looks too good to be true, it probably is.