There are several key factors that you have to nail down in order to succeed with money.

Next to increasing your income, perhaps the most important factor is tracking your expenses.

But with multiple bank accounts, loans, credit cards, and other types of accounts, how do you keep track of all your spending without losing your mind?

There is a right way and a wrong way to track your spending if you want to be as efficient as possible.

In this post, we’ll break down step-by-step how to keep track of your spending so you can take control of your finances.

But first, let’s take a look at why it’s important to track your spending.

Why Track Your Expenses?

Tracking your expenses might seem like a lot of work when you’re initially trying to do so. It can be a headache trying to track down every little expense you’ve incurred, but the initial time investment is worth it for several reasons.

You Save Time

Although money is very important (as you need it to live), the one asset that is arguably more valuable than money is your time. Many people say that you can always earn back money, but you can never get more time.

Although money is very important (as you need it to live), the one asset that is arguably more valuable than money is your time. Many people say that you can always earn back money, but you can never get more time.

Freeing up your time grants you more opportunities to increase your income and do the things you love.

When done the right way, tracking spending saves you a ton of time (and indirectly “makes” you more money). You can consolidate all of your expenses into one area. Instead of logging into 10+ accounts to see where you stand financially, you can take a quick glance at everything in one area. This makes checking your spending habits much more viable, as it won’t eat up an hour of your time every day.

(Plus, it feels kind of cool to take a quick glance at all your financial information and know where you stand. It gives you a reassuring feeling of control.)

Although you may have to invest a few hours up front, the amount of time you’ll find yourself saving within days is huge.

Not to mention that you’ll be enlightened about your financial situation, which brings us to our next point…

Less Stress

Yet another benefit of tracking your expenses is the stress reduction factor.

When you’re in the dark about your financial situation, money can be a distressing topic. You never know how large your next utility bill is going to be, or if you have enough money to make your car payment.

This is especially important when it comes to non-essential purchases. Expense tracking lets you explicitly determine whether or not you have enough money to afford that next vacation or that new TV.

Of course, you could put it all on the credit card. But that only delays and most likely builds on the inevitable stress avalanche that will hit you down the road.

Not to mention all the extra interest you’ll have to pay and the damaged credit score.

Even if you’re barely scraping by, you gain peace of mind when you have a concrete picture of where each and every dollar is going. Sure, you may not have a lot of money; but at least you’re empowered by knowledge of your financial situation!

Helps You Plan

Tracking your spending is a critical part of budgeting. Without hard data, you can’t form any sort of action plan to increase your financial situation.

On top of that, failing to track spending makes it hard to plan for fun things. Again, tracking your spending helps you plan for things you’d like to do, like travel. You’d never be able to feel secure in making large expenditures on fun activities like that if you have no clue where any of your dollars are going.

Planning isn’t just for fun things, either. Things like buying a house and attending college require immense amounts of money, and by extension, a lot of planning. Keeping track of your expenses will help you identify ways to squeeze some extra money out of your paychecks.

Financial Awareness

When you sum up all the benefits of tracking your expenses, it comes down to one theme:

Financial awareness.

Gaining awareness of your financial situation is key to taking steps necessary to improve. You can identify areas that you’re wasting money in and use your spending data to form a plan on improving your finances.

Wealthy people generally have their finger on their financial pulse in some way at all times. Of course, there are exceptions, but they are few and far between. At some point, anyone who became rich had to track their spending and identify how they can use their money more efficiently.

So How To Track Expenses…

Now that you know the why of keeping track of your spending, it’s time for you to learn how to do it in a way that saves you time and puts your mind at ease.

This is going to take some effort at first, but I promise that the initial effort is well worth it when you know where your money is going.

Step 1: List Out All Your Monthly Bills

The very first thing you need to do is pull together all your monthly/regular bills. This includes things like

Rent/Mortgage

Rent/Mortgage- Utilities

- Car payment

- Insurance

- Credit cards

- Childcare

- Interest

These items are your “fixed expenses”. While some of them may vary slightly, you’ll most likely being paying these on a regular basis (typically monthly).

Your fixed expenses will most likely make up a large chunk of your spending, so it’s crucial to know exactly how much is going towards these each month.

Unfortunately, it’s not all that easy to reduce your rent/mortgage payments or your car payments. These payments are probably going to be the exact same every month.

That doesn’t mean you shouldn’t keep track of them! They are part of your whole financial picture.

On the other hand, it’s more obvious why you should track the other “fixed” expenses. These ones DO fluctuate every month, so you’ll be able to identify ways to reduce them later.

Unless you make drastic lifestyle changes, you won’t be able to make much change to these bigger expenses. That’s where tracking your “other” spending comes in.

Step 2: Spend A Week Or Two Tracking Other Spending

Now that you’ve compiled all your fixed expenses, it’s time to see where the rest of your money is going. Your “other spending” is going to include things like

- Gas

- Groceries

- Coffee

- Restaurants

- Entertainment

This is where you’ll discover a lot of money that you could be saving. One thing that many people discover is sucking away their money is food. At first, a few bucks on a sub for lunch doesn’t seem like much. In one month, however, that sub for lunch can quickly add up to a couple hundred dollars!

Add that together with other small expenses, and you’re looking at hundreds of dollars.

While your tracking your “other” spending for a week or two, make sure to record everything. Keep a notebook or collect all your receipts if you have to. It sounds like a pain, but it’s worth it.

At the end of this week/2 week-long experiment, you’ll be stunned at how much money you spend on small, ordinary purchases.

Check Out Your Larger Expenses

Infrequent but large one-time expenses should be reviewed in addition to the previously mentioned expenses. These expenses include

- Car/house repairs

- Education

- Furniture/TV sets

- Travel

- Emergencies

Because of the infrequency of these expenses, you might be tempted to get lazy and ignore them.

Don’t ignore them.

Failing to track these expenses will leave you unprepared for similar future expenses. This can result in a drained bank account or unnecessary debt.

These can be hard to track down, however, so vigilance is key. If you have to, go through past bank statements, credit card statements, receipts, and other records to find these expenses.

Sounds like a pain, I know. But you want to be prepared for these expenses, especially if it’s something like a car crash or a hospital visit.

Step 3: Review All This Spending Data

By now, you’ve done three things: listed your fixed expenses, tracked a typical week of other out-of-pocket spending, and reviewed large but infrequent expenses. Pull all of this information together so you can get an idea of your total monthly expenses.

Once again, you’ll be surprised at where your money is going.

Aside from food, another big area that always catches people off-guard is their subscription purchases. Things like Netflix, Hulu, Amazon Prime, and other subscription services can add up to a lot of extra expenses each month. Many people don’t even realize this because they set their subscriptions up and then forgot about them!

Now if you truly enjoy and derive utility from these subscription service, you don’t have to cancel them. However, chances are there’s at least 1 subscription you could get rid of.

At this stage, you’ve probably already seen some areas that could use improvement. Don’t act on them just yet, though! Leverage modern technology to make your life easier by signing up for a personal finance app.

Step 4: Use A Personal Finance App

Spreadsheets are a favorite tool among personal finance hobbyists. They can be useful in the right hands, but they often take a lot of extra time that could be used elsewhere. Even if you find budgeting spreadsheet templates online, you can’t necessarily take it with you wherever you go!

(And who knows if the person who created it knew what they were doing!)

Luckily, with the advancement of technology in general and the spread of mobile technology in particular, there are tons of budgeting apps available.

The power of these apps cannot be understated. Most of these apps lets you link your bank accounts, loans, credit cards, and other financial accounts to the app so every transaction flows through into one area. They serve as a “personal finance dashboard”, saving you hours of time that would’ve otherwise been spent updating spreadsheets or wallowing about in financial darkness.

One of the most popular personal finance apps is Personal Capital. Other apps include YNAB (“You Need A Budget”), Intuit’s Mint app, and Clarity Money. Each of these apps has a slightly different focus, but they all allow you to track your expenses in one location.

Step 5: Identify Ways You Can Save Money

Barring any incompatibilities between your personal financial accounts and your personal finance app, all your spending should now flow through to your account in the app your chose.

After ensuring that everything is properly organized and categorized, spend some time looking at your expenses and try to identify trends.

Are you spending $7 on a sandwich for lunch every day? Maybe you have a Netflix subscription you never use. Or perhaps you’re getting hit with hard with interest on a loan and want to explore options to consolidate debt and obtain a lower interest rate.

With all your financial information in front of you, it’s much easier to identify ways to cut back on expenses. In other words, it’s planning time!

Step 6: It’s Time To Plan

Now that you can identify ways to cut spending, it’s time to make a plan.

When I say make a plan, I actually mean make two plans:

- A plan to cut spending

- A plan to achieve your financial goals

Both of these plans will play off of each other.

The First Plan

Almost everybody is spending money that they don’t need to spend.

The worst part is, many don’t even realize it!

These expenses that you were previously unaware of would be great areas to cut spending in. The money you save might be a few dollars or a few hundred depending on your spending habits, but it adds up either way.

Once you’ve formulated your plan to cut your spending, you can use all that extra cash to plan for the future.

The Second Plan

After you’ve began cutting back on spending, you’ll have extra money that can be put to better use. Now’s the time to set responsible financial goals, such as saving for college, paying off loans, or saving for retirement.

I’m not going to go into planning for the future too much here, but I will say that saving a few bucks a month really adds up over the years.

Even if you don’t have any sort of huge financial goal at the moment, it never hurts to have some extra cash to sock away in the bank or some low-risk investment.

Which Personal Finance App Should You Use?

Ok, so now you have a complete guide to tracking your expenses in a way that’ll save you time and headache.

One problem…

Which personal finance app is the best?

While that’s hard to say, one of the most popular is Personal Capital.

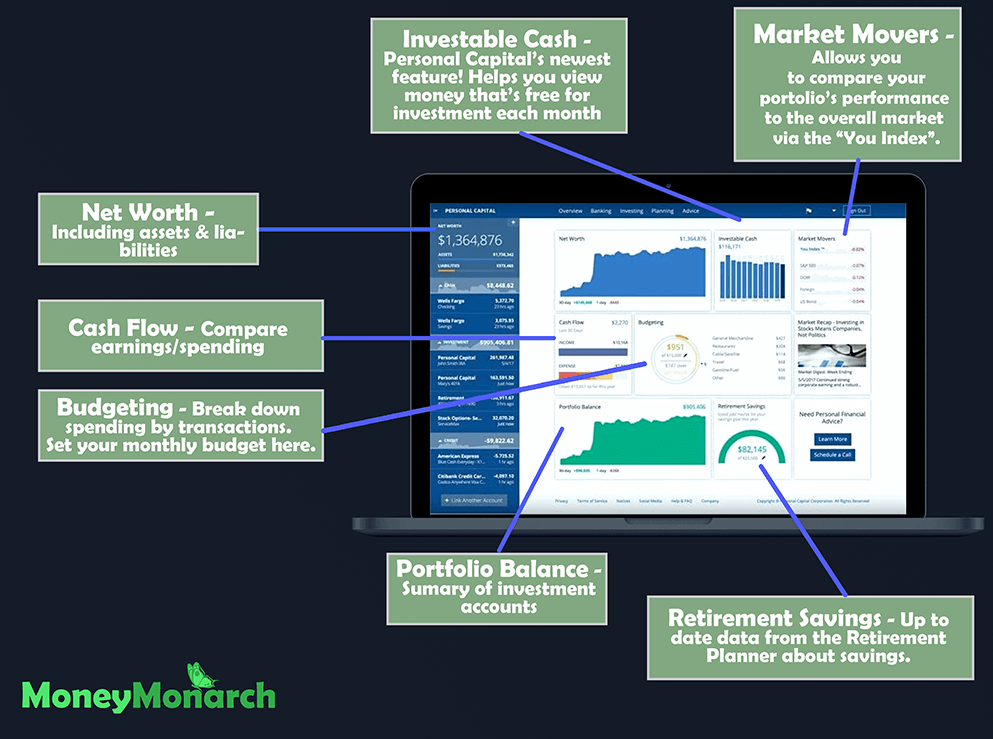

Personal Capital is one of the most comprehensive personal finance apps out there, as it gives you a complete look at everything. Let’s break down everything Personal Capital has to offer.

Overview

The Overview screen serves as your main dashboard. You can view the balances on all your accounts, your recent spending history, upcoming bills, trends, and more. This screen takes the most essential information from the other screens and puts it in one convenient location.

With this setup, you can know where you stand financially within minutes.

Transactions

Here, you’ll find every transaction for each account you have linked to Personal Capital. This screen feeds into the budget screen, so it’s important that you check on this one every so often to ensure your transactions are categorized correctly.

Speaking of categorization, you can do all that while in the Transactions screen. You can even make your own categories to tailor your expense tracking to your lifestyle.

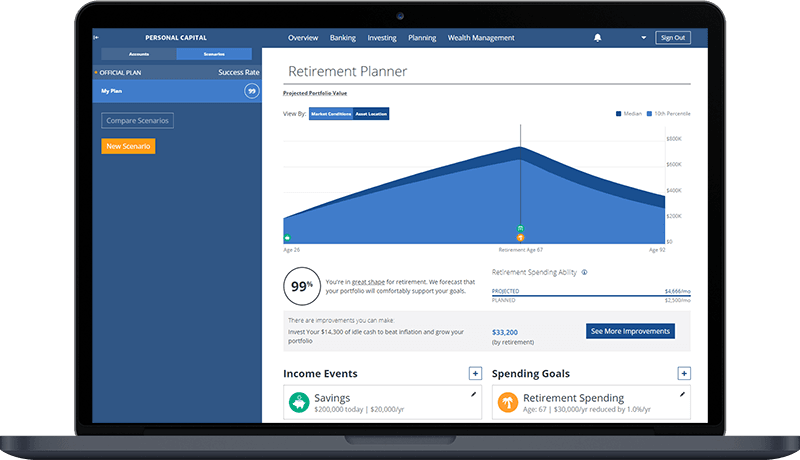

Retirement Planning

Yes, Personal Capital will even help you manage saving for retirement. Based on average life expectancy and amount saved per year, this tool calculates projected monthly spending capabilities and advises adjustments to make sure you retire with a plan.

Bills

Personal Capital lets you record those fixed expenses in this screen. When the bill is close to coming due, Personal Capital will push a notification to your Overview screen so you’ll never miss another bill.

This area plays off of the Budgets area, since you can set up your monthly bills in the Bills area and compare them to your budget in the Budgets area.

Budgets

This might be the most important screen for expense tracking. You can set a budget for almost anything, even your income!

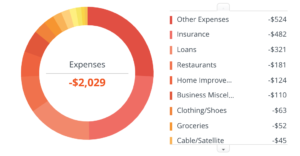

This tool allows you to compare expenses from month to month and adjust your budget accordingly to meet your goals. Along the right side you’ll also see the areas with the highest expenditure each month.

Again, it’s crucial that transactions are properly categorized so that your budgets are correctly represented. No app is perfect, and Personal Capital is no different. Personal Capital isn’t human; it can’t identify the category for ever single transaction all the time, so you will have to check your Transaction screen every so often.

Investments

Personal Capital’s Investing area lets you analyze the performance of any investments you link to your Personal Capital account. While not as informative as checking your actual investment app or speaking with your financial adviser, it still provides useful information in a convenient location.

Wealth Management

Personal Capital’s Wealth Management section is available to customers with $100,000+ of investing power. Once signed up you’ll have access to a team of financial advisers and their advising algorithm to help grow the money you’ve worked hard to save.

Personal Capital Is The Most Popular Personal Finance App

Personal Capital is one of the most popular personal finance apps in the world, and for good reason. It has all the features necessary to track your expenses, but it also has so much more too it.

Click here if an all-in-one personal finance app would help you sort out your finances!

Spend Less Time AND Money!

When you don’t have a system in place to keep track of your expenses, it can be hard to know your financial situation. Just thinking about how much cash you have can stress you out.

Unfortunately, unless you pay someone to do it for you, there’s no way to suddenly have a system in place with the snap of a finger. It will take a bit of time and effort.

However, if you follow the steps laid out in this article and put some time into figuring out your spending habits, it will pay dividends (figuratively, not literally) down the road in the form of time and peace of mind.

So track down all your expenses, register with a personal finance app (like Personal Capital), and take control of your spending!