In Depth Betterment Review

The robo-advisor market is exploding. Because of this, robo-advisors are constantly seeking ways to differentiate themselves acquire users from the competition.

Sites like M1 Finance, TD Ameritrade, Blooom, Personal Capital, E-Trade, and others each offer a slightly different experience. Some offer a vast range of investment choices; others provide investors top-of-the-line tools for investment management and analysis. Still others maintain huge libraries of educational content and news updates.

Betterment, another robo-advisor, has established itself as a leader among its robo-advisors peers.

But what makes it such an amazing tool for anyone looking to build their wealth and maximize their savings?

What is Betterment?

Betterment is a robo-advisor that prides itself on being a “smart money manager”. They have both a main website and a mobile app.

Founded in 2008 by two roommates named Jon Stein and Sean Owen as well as an entrepreneurial-minded securities attorney named Eli Broverman, the company now has around $15 billion in assets under management.

Jon Stein had the idea after getting sick of managing his investments through several brokerage accounts, an action that caused him to lose tons of time and cash through always monitoring the market and reacting emotionally. He brought his economics education to Betterment, Sean brought his software engineering background to the table in order to build Betterment and everything it needed to work properly, and Eli used his regulatory knowledge to figure out how to navigate the complex regulatory environment.

Jon is now the CEO and Eli is the President of Betterment, while Sean left to pursue other software engineering interests.

But back to Betterment itself.

Betterment is meant to serve as an all-in-one location for your investments and provides a ton of features to make investment management easy and inexpensive.

Betterment App

Betterment’s mobile app manages to condense your wide array of financial information into an intuitive format that’s easy on the eyes.

They actually redesigned the app to focus more on your financial “big picture” than your investment performance to reduce your psychological exposure to market volatility and thus reduce the chance you make emotional investment decisions.

And yet, you can find nearly anything you might need in their app, whether it’s a quick glance at your portfolio or a deeper dive into particular assets and their respective performances.

Betterment Account Types

Betterment has two account types at different price points, giving you choice in how many Betterment services you’d like to pay for:

- Betterment Digital

- Betterment Premium

Betterment Digital is their cheaper legacy option. Betterment Premium is a step up, offering more features but at a higher cost.

Betterment Fees, Features, and Account Minimums

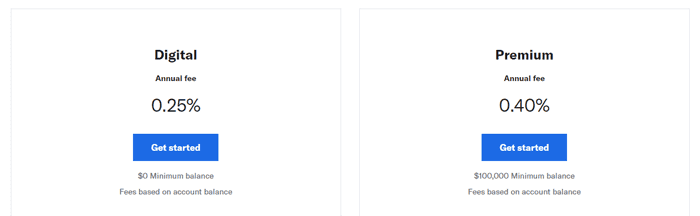

Betterment Digital

Betterment Digital is their base-level plan. It charges you an annual 0.25% fee on your total account balance. In addition, It requires no account minimum in order to keep an account open.

A Betterment Digital account grants you access to

- Personalized financial advice

- Diversified investment portfolio choices

- Various tools and features for better investment management

- Customer support

Betterment Premium

Betterment Premium is their premium level plan. As the premium plan, they do require a minimum account balance to the tune of $100,000. Betterment Premium charges you a 0.40% fee on your total account balance as well.

But in exchange for these higher costs, Betterment Premium includes everything that comes with Betterment Digital plus:

- In-depth investment advice on investments outside Betterment (such as your 401k or real estate investments)

- Unlimited access to Certified Financial Planners that provide you guidance on significant life milestones (marriage, starting a family, retirement, home-buying, etc.)

$100,000 might seem too high to be a “minimum” for the average investor, but the features Betterment Premium are usually much more helpful to those who have enough money to invest hundreds of thousands. Thus, Betterment Premium could be better for the higher-net worth investor.

Betterment’s Referral Program

Are you sick of paying to have your investments handled? Sick of paying fees to invest on your own? Normally, you’d be restricted to apps like Stash and Acorns. Robo-advisors including Betterment generally charge account fees to make money and keep their service running.

But you can earn your way to free investment advice and management with Betterment’s referral program, up to an entire free year!

Here’s how it works:

Every referral that funds their account earns you 30 days of free Betterment. Get 3 of your friends to fund accounts and Betterment will give you a one-time free year of Betterment.

Oh, and each of those referrals gets 3 free months for themselves if they sign up using your referral code.

We’re sure you’ll love Betterment independent of the referral program and will want to share it with others anyways, but if you can earn both you and yourself free Betterment usage by spreading it to others, there’s little reason NOT to sign up.

Betterment’s Pros

Portfolio Strategies

Betterment offers 4 curated portfolio strategies, each with it’s own focus and set of benefits:

- Betterment Portfolio Strategy (their main one)

- Socially Responsible Investing

- Goldman Sachs Smart Beta

- BlackRock Target Income

The latter 3 retain the same core philosophy and principles as the 1st one, but changes up certain investments to cater to several types of investors. They do it all without sacrificing low cost and diversification.

Plus, each one can be adjusted to your preferred risk level.

Yet if for some reason you don’t like any of these, you can even create your own using their Flexible Portfolio feature!

Betterment Portfolio Strategy – The Main One

Betterment invests in ETFs that span a range of 12 classes of assets.

ETFs are funds that track an index or other “bundle” of assets, yet they’re traded like individual stocks. You own all the assets within the ETF indirectly through an intermediary. In other words, one share of ETF automatically made you indirectly own several stocks at once. They’re generally considered good passive investments due to liquidity, diversification, and low management fees.

As for their portfolio strategy, it’s a diversified mix of ETFs on a global scale. They look for low-cost, index-tracking ETFs with high liquidity to minimize costs and risks while maximizing your returns.

Each ETF is weighted differently in the overall portfolio strategy.

Don’t like the current weights?

Betterment’s Flexible Portfolio feature lets you adjust the weights to suit whatever balance of investments you desire.

Socially Responsible Investing

Many companies offer ways to invest in a socially responsible way, but it usually comes at the cost of higher fees, less diversification (higher risk), and loss of cost/tax optimization opportunities.

Investors can try to invest responsibly themselves, but that takes many hours of not only learning and understanding investments, but keeping up with current events to see which companies ARE socially responsible choices.

Not with Betterment.

Betterment analyzed every low-cost ETF available in an attempt to find socially responsible investments that could replace portions of their core strategy without sacrificing the low cost and diversification of the strategy.

And so, they were able to replace US Large Cap Stocks and Emerging Market Stocks with more socially responsible choices.

Not everything has been replaced, but by replacing ETFs containing certain large, socially irresponsible stocks with more responsible ones of equivalent market cap, your overall social responsibility is better.

Use your money to influence positive change in the world with the Socially Responsible Investing portfolio.

Goldman Sachs Smart Beta

Built by Goldman Sachs, you’ll like this portfolio strategy if you’re looking for a little more risk and reward.

Smart Beta moves away from pure market cap, taking on different risks but aiming to outperform a normal market cap investing strategy without sacrificing the other benefits of Betterment’s core portfolio.

This strategy utilizes investments that meet the following criteria:

- Good value – Low price to earnings ratio.

- High quality – Sustainable profitability over time. Focus on companies with strong fundamentals.

- Low volatility – Low volatility stocks sometimes have higher returns than more volatile stocks, but with less giant swings in value.

- Strong momentum – Strong upward trend in price.

BlackRock Target Income

Built by global investment management company BlackRock, this portfolio contains 100% bonds with varying yields. It’s built this way to reduce your exposure to stock market volatility and provide a more consistent income stream while preserving your capital.

Target Income is excellent for conservative investors who’d rather rely on consistent income than take bigger chances on asset appreciation.

Financial Planning Packages

Betterment goes the extra mile by offering financial planning/advice packages for both general financial advice and several of life’s greatest milestones. Each package consists of a call with a financial advisor.

Their $199 Getting Started plan helps new investors set up their account for maximum return and optimization in one 45-minute phone call. The other 4 packages cover general financial health, college, marriage, and retirement. These latter 4 each cost $299 and consist of one 1-hour phone call each with a financial advisor.

A Goal-Based Philosophy

Betterment’s all about the future. They offer 5 types of goals you can choose from:

- Emergency fund (3-6 months of expenses)

- Education (college)

- Major Purchase (houses, cars)

- Retirement

- General Investing (a “play” account for general wealth-building)

You can choose any number/combination of these goals for Betterment to track. Each goal gets its own account.

When you sign up, they walk you through a goal-setting process. Using your age and income, they estimate target amounts for your emergency fund, retirement savings, and general investing goals as these can be determined without other information (such as the price of the house you’re buying for the Major Purchase goal).

It doesn’t stop there.

They’ll then suggest account types and investment allocation based on your risk tolerance and when you need your money.

Betterment recommends an auto-deposit amount for each goal as well to make your investing goals that much easier to achieve.

They even let you sync outside accounts so Betterment can track your overall progress towards your goals.

Account Minimums

Betterment requires absolutely $0 for their Digital plan. This means any investors can get started with Betterment and work at their own pace, rather than needing to front tens of thousands of dollars.

Of course, you have the $100,000 account minimum for the Premium plan.

But you have options. More “average” investors can start with Digital and work slowly on building their wealth, while wealthier individuals can opt for the Premium plan as their financial situations and general lifestyle may require further outsourcing of investment advice.

Fees

Betterment charges 0.25% annual management fee for a Digital account, which is fairly inexpensive compared to the competition.

Especially when you consider the level of stuff Betterment provides.

The Premium account bumps that fee up to 0.40%. A little higher, but unlimited phone access to certified financial planners is worth much more than that.

Portions of Digital account balances over $2 million are only charged 0.15%, while the same scenario runs you only 0.30%. By the time you have $2 million under management, there’s almost no point in NOT paying 0.05% extra per year for access to several CFPs.

Tools

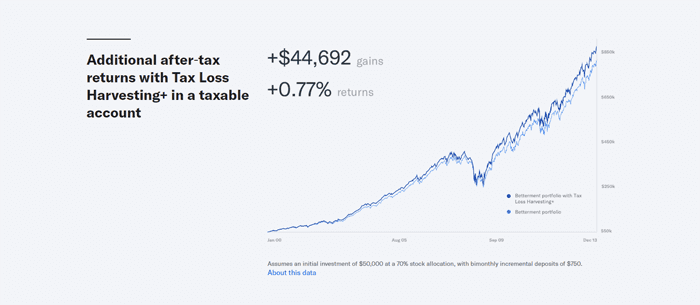

Betterment has several amazing tools. One of their best is Tax Loss Harvesting+.

Tax loss harvesting is the act of selling some securities at a loss for tax purposes. You’ll inevitable have some gains on the sale of securities, so selling some securities at a loss offsets those gains on your tax return, reducing your taxable income.

In other words, it’s like a tax write-off.

Tax Loss Harvesting+’s automated algorithms regularly look for harvesting opportunities that won’t trigger tax-disadvantageous short-term capital gains. It automatically sells securities at a loss when it finds opportunities that match its criteria at no additional trading cost. It’ll then reinvest your tax savings and automatically rebalance your portfolio.

Their other great tool is their retirement planner called RetireGuide.

RetireGuide is unique because it projects your annual spending power in retirement; this is much more helpful to know than simply your projected savings.

Betterment lets you open several types of IRAs and other types of retirement accounts. You can also link outside accounts and they even let you rollover outside accounts. Betterment then asks for several pieces of information about your current financial status and your retirement goals.

Betterment constantly updates your retirement goal based on all linked account balances. You can change any retirement inputs you want (such as retirement location) and it’ll adjust your goal.

RetireGuide answers many common retirement questions as well, and even advises on ways to increase your retirement savings (such as opening a new IRA).

Other tools include

- Charitable giving tool – Donate appreciated securities directly and tax-efficiently on Betterment.

- Two-Way Sweep – Link an external checking account to your Betterment savings. Two-Way Sweep will analyze your regular spending habits and move what it deems to be unused cash based on its analysis to your savings. It’ll move cash back to your checking account if your checking falls below your defined amount. Two-Way Sweep notifies you of money movements so you can cancel them if you’d like.

Bank Accounts

Believe it or not, Betterment also has an online savings account with. No checking account yet, but you can join the checking account waiting list.

And you should, because doing so boosts your APY from their standard 2.14% to their promotional 2.39%. There’s no obligation to open an account when you’re on the waiting list, so there’s little reason not to snag your spot.

The savings account has no fees nor do they have a minimum balance; all you need is a $10 opening deposit to open the account. It’s FDIC-insured up to $1,000,000.

The checking account will have no maintenance fees, no overdraft fees, no minimum balance, and will even reimburse ATM fees. It’s slated to have a debit card too.

Betterment’s Cons

To be quite honest, Betterment doesn’t have any major downsides. It’s not perfect, though; some of its drawbacks could turn off some types of investors.

Consider these drawbacks alongside all of Betterment’s strengths if you’re thinking about signing up.

No Direct Indexing

Betterment unfortunately doesn’t offer direct indexing for ETFs unlike one of its fierce competitors, Wealthfront.

But what is direct indexing?

Direct indexing is a recent finance technological investment that allows investors to buy shares of each individual component asset directly.

See, you have to pay “expense ratio” fees on ETFs to cover management costs. On top of that, you can’t take advantage of tax-loss harvesting as much since you only own one asset (the ETF share) rather than multiple (as if you directly owned each security in the fund).

Direct indexing minimizes these problems. You don’t have to pay expense ratios on individual stocks. Also, since you now own each stock individually, there’re many more opportunities for tax-loss harvesting.

Not all is lost, though. You can use Betterment’s Tax-Coordinated Portfolio to maximize your tax advantages, as well as analyze the tax implications of portfolio actions with the Tax Impact Preview tool. More on that later.

No REITs (In General)

Real estate is always lauded as a good investment, yet the average person can’t exactly afford to buy and sell entire properties.

Real estate investment trusts, or REITs, provide a solution to that. REITs are companies that own and operate income-producing properties. In short, you invest in the REIT, the REIT uses your money to earn more real estate income, then distribute earnings back to you.

Unfortunately, Betterment does not offer REITs as an investment option UNLESS you invest using the Smart Beta portfolio strategy.

However, that’s not Betterment’s main strategy. They don’t have REITs in their core portfolio strategies.

While not a deal-breaker for most seeking a robo-advisor, real estate enthusiasts will be sorely disappointed if they don’t want to use the Smart Beta strategy.

Leaving Betterment

Betterment doesn’t provide many reasons to leave. Still, some people might want to pack up and move their money elsewhere.

Sadly, you have to fill out and mail a lot of paperwork to do so.

Not a crushing blow against Betterment, but it’s inconvenient for people who want and/or need to close up their Betterment accounts.

The Verdict

Betterment truly is a leader among robo-advisors. As you can see, the few minor drawbacks are crushed by an avalanche of good stuff.

While not for everybody, Betterment is an excellent option for a huge swath of the investing population.

Still, we think Betterment is best for

- Hands-off investors – Diversify and let your money grow with ETFs

- Investing newbies – Low account minimums, tons of financial advice/content, financial planning packages, tools

- Goal-based investors – Tons of tools that are based around your goals

- Retirement savers – RetireGuide

Sign up for Betterment today if you’re looking for a solid blend of risk, reward, tools, educational content, and low costs.