Stash App Review – What You Should Know About This Investing App

The investment world isn’t simple by any means.

After all, there are Ph.D.-level programs focused on finance and investing!

Stash is an app that aims to make investing doable and a bit fun for even the most novice of investors.

It does this by renaming many investment funds to more understandable names; Stash also provides a lot of learning material to cut your learning curve.

In addition, it places an emphasis on small, consistent investments over time.

We’ll get to our full Stash review in a second, but first, let’s explain why investing on such a small level is a good strategy.

Small Investments Add Up

There’s no way short of the lottery or receiving and inheritance to get rich quick, but making small, consistent investments is definitely a “get-rich-easy” method.

However, most people prefer to keep as much of their own money in their pockets as possible, and so they may avoid investing until it’s too late.

Humans just work this way. Regardless of the massive benefits of diligently investing your money, people just aren’t inclined to do something that doesn’t reap them an immediate (or at least easily-foreseeable) benefit.

Making small, automatic investments over time can counteract this tendency. If you make $4,000 per month and your expenses are $3,500, you’d usually want that $500 for yourself, rather than giving any of it to the stock market.

But if you were to set a small, $100 automatic monthly investment, would you ever notice that $100 disappearing from your account every month?

Given that tons of people don’t notice all the money they’re losing to various subscription services, probably not.

But of course, investments don’t just sit there doing nothing; they earn more money for you!

So not only will you build up a giant investment portfolio, but it’ll grow beyond your principal investment.

Then, there’s the power of compounding.

This is where dividend-paying investments truly shine.

See, your dividend payments are akin to “interest”. You can take this “interest” and reinvest it into your “principal” for higher dividends next time.

Do this long enough, and you could build up a decent-sized passive income stream without reducing the principle.

Many retirement investors use this strategy.

Speaking of retirement…

Saving For Retirement

Retirement is a huge goal, but it can often seem so far away that you don’t really care to start saving.

That’s one of the worst actions you can take, but it can be difficult to care about retirement savings when you’re young.

Small, consistent investments become much more important because of this. This strategy is one of the easiest and most painless ways to build wealth for retirement.

Now, on to our Stash Review.

Stash App Review – Pros and Cons

Stash’s App Pros

Values-Based Investing

Stash’s most notable feature is it’s emphasis on values-based investing.

It renames their ETF offerings to more closely reflect what you’re investing in for this to work. For example, the boring sounding “Vanguard Total International Bond ETF” is called “Bonds Worldwide”. Such a name makes it much more obvious what kind of investments are held in that ETF.

Until recently, the 3 main categories were I Believe, I Want, and I Like. They’ve since renamed them to Beliefs, Balance, and Life, but the concepts stay the same for each.

Belief investments are centered around socially responsible investing. For example, if you believe that green energy is the way forward, you could put your money into the “Clean & Green” and “Combat Carbon” funds.

If you want to help change the world, an investment in this category could do that.

Balance funds are more about your personal investing goals. Whereas Belief investments care primarily about helping the world, Balance places a bigger emphasis on risk tolerance.

Some Balance investments include “Blue Chips”, a low-risk fund with America’s largest companies; “Corporate Cannabis”, a high-risk, high-reward fund that invests in the growing legal cannabis industry; and even a dividend-focused fund aptly named “Delicious Dividends”.

There also 3 ETFs tailored completely to risk levels; they’re called Conservative Mix, Moderate Mix, and Aggressive Mix.

Finally, the Life category has things you may enjoy as a consumer. One example is the “High Voltage” fund that invests in utility companies. Another is the “Social Media Mania” ETF, who’s major holdings include Facebook and Twitter.

If you’re looking for individual stocks, Stash offers a huge selection of those as well.

Lastly, if you aren’t sure of an investment but want to track its performance without risking your money (or you just want to check it out later), you can bookmark investments. They’ll appear in the Bookmarks section of the investments area.

Educational Materials/Guidance

One of Stash’s goals is to educate investors so they make wise investment decisions.

See, after it asks you the typical investor profile and risk tolerance questions, it’ll give you investment suggestions with which to build your portfolio.

The cool part is if Stash notices your portfolio lacks diversification, the Coach feature will provide you educational material on the importance of diversification.

But the learning doesn’t end there.

Stash has an entire “Learn” area full of articles covering a myriad of investment topics, from investment news to learning materials such as articles on the importance of diversification.

On top of these educational materials, Stash offer some tools to help guide you through the investing world.

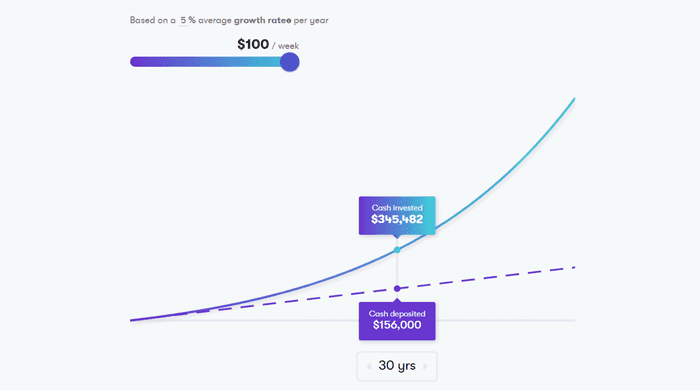

One of these is a tool that measures your money’s potential. It gives you a sliding scale to adjust your theoretical monthly investment and growth rate, then spits out 1-year, 5-year, and 10-year predictions for your portfolio’s total value.

Gives you a bit of a nudge to invest more when you see what kind of money you could be sitting on in a decade.

Another tool lets you view your portfolio’s history. If you invest consistently over time, this screen is very satisfying and can help you “stay on the wagon” as you can see your portfolio grow month-to-month.

Their aim with these materials and tools is to make investing as beginner friendly as possible, and all these educational materials really help them achieve that goal.

The Auto-Stash Feature

What beginner-friendly investment app (or any investment app for that matter) would be complete without a way to set and forget your investing efforts?

Stash’s automatic investing features is their eponymous auto-Stash.

Auto-Stash used to just be their term for automatically investing, but they’ve since expanded upon the idea and turned it into a small suite of automation features.

First of all, you can set up automatic investments for any of the funds Stash offers. When you’re making a one-time investment, Stash will ask you if you want to make an auto-Stash for that investment.

However, if you’re looking for more choice but still want to set aside money automatically, you can also have Stash pull money into its cash balance. Then, it’s up to you to decide where the money goes.

Both of these are part of the “Set Schedule” auto-Stash feature.

Then, there’s Round-Ups.

Similar to Acorns, Stash will round up purchases from your linked bank accounts and transfer them to your account balance.

However, it only does this when your round-ups total to $5.

Stash’s last auto-Stash feature is called Smart Stash, which innovates pretty well on the round-up idea.

See, if you turn on Smart Stash, Stash will analyze your earning patterns and spending habits for your linked account.

It’ll then set aside spare money after those transactions and automatically transfer the spare money to your Stash once it hits a max transfer amount that you specify.

Worried about overdrawing your account this way?

Fear not, because Stash refrains from any Smart Stash transfers if your linked account falls below $100.

Smart Stash transfers occur Monday-Friday between 9am and 5pm. If you accumulate any savings over the weekend, they’ll be added on Monday and then transferred.

Low Account Minimums

The whole point of “small investments over time” would be rather moot if you needed $1,000 to start investing.

But luckily for you, Stash only requires $5 to start building your portfolio. That means you can create a diversified portfolio rather quickly and without a lot of money.

Stash will even give you $5 just for signing up which you can begin to use to get some free stock.

Account Types

Stash doesn’t just offer personal or retirement accounts; they offer both types!

In addition, they offer custodial accounts if you want to build wealth to pass on to your children.

In terms of retirement accounts, they offer both traditional and Roth IRAs.

Every type of account is relatively easy to open, and they all have the same low account minimums we just discussed.

Achievements

It’s rewarding to see your portfolio grow and watch your assets increase in value as you continue to auto-Stash every month.

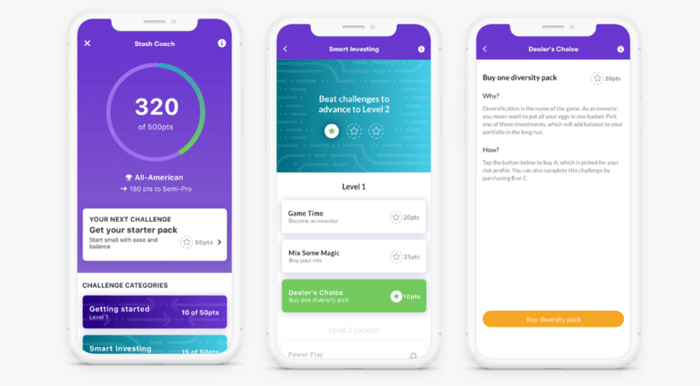

To make the experience even more rewarding, Stash included investing challenges as part of its Coach feature. You can complete these challenges to earn in-app points and advance through Stash’s ranks.

Most of the challenge categories have multiple levels of challenges, so the incentives keep coming.

There are several challenge categories:

- Weekly Challenges – These usually involve consuming educational materials like articles or podcasts. Weekly challenges are meant to get you immersed in investing content for a better learning experience.

- Investing Basics – The easiest to earn. Join stash, make your first deposit, and link your bank are the only challenges here. Level 1 is the only level.

- Investing Foundations – You can complete these challenges by making investments and setting up investment schedules.

- Investing Habits – You’re rewarded for maintaining your investment schedule, since consistent investing is the key to wealth-building.

- Retirement Basics – Contains challenges centered around investing for retirement and Stash’s retirement account.

You sadly can’t trade in the points for stock or cash, but they serve as a decent incentive to build and diversify your portfolio.

Stash’s Cons

Fees On Small Balances

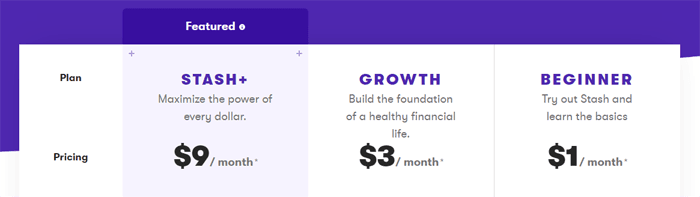

Stash has some steep investment fees.

On traditional, personal investment accounts, Stash charges $1 for balances under $5,000. Their retirement accounts charge $2 per month for the same balance.

After $5,000, both accounts switch to 0.25% of total assets per year.

Now, $1 or $2 a month isn’t much at all.

But typical investment fees are much lower than that in terms of percentage.

The best rate you’ll get is the 0.25% after $5,000, but since Stash targets new investors, most won’t have $5,000 in their portfolio for a long time.

Even then, 0.25% isn’t that low for an investment fee.

No Automatic Rebalancing

Automatic rebalancing is a useful feature that ensures each of your portfolio’s holdings don’t get out of whack and mess up your portfolio’s balance since changes in the prices of your holdings can change their weights in your portfolio.

Apps that have this feature rebalance by buying and selling fractional shares to bring your portfolio’s holdings back to their respective target weights.

A robo-advisor called M1 Finance does this quite well.

Although Stash offers automatic investing in the form of auto-Stash, it sadly does not rebalance your portfolio at all.

The best it does is let you set an auto-Stash for each holding in your portfolio, so you can at least prioritize your investments based on their importance to you.

No Tax-Optimization Features

Stash unfortunately lacks in the tax-optimization features department, although that’s to be expected given their target market of beginner investors.

While everyone wants to maximize their tax savings, new investors just don’t prioritize it and so Stash didn’t assume it would be worth to include.

They probably thought that it would add unnecessary complexity to a beginner-focused app.

The Verdict

Overall, Stash is best for new investors who just want to learn the basics and learn at their own pace.

They make investing a little more engaging by renaming investment funds from their “boring” real names to something more understandable for beginners.

On top of that, they put a heavy emphasis on learning so you can grasp what investing’s all about.

If you’re a veteran investor with lots of money to throw around, then Stash is definitely not for you. Other apps and robo-advisors have plenty more tools to maximize your returns and minimize expenses.

But if you’re just trying to get your feet wet and play investing on “easy” mode, Stash provides the perfect platform.