How to Fill Out a Money Order Guide

More companies, especially landlords, are adopting online payment portals so customers/tenants can pay their bills instantly with their bank account or credit card.

But some companies who’s business involves larger bills (again, especially landlords) still prefer physical payment methods instead. Many will take personal checks, but some require only money orders for security or other reasons.

What is a Money Order?

A money order is a prepaid financial instrument that can be used when the business you’re paying doesn’t accept cash or checks. They are represented by little slips of paper the money order buyer fills out.

You can buy money orders for a a fee that ranges from $1-$5 depending on where you purchase the money order. Avoid using a credit card, though: money orders bought with credit cards are technically cash advances (you’re converting some of your credit to cash), and they’re often treated as such by your card company.

Why Should I Use A Money Order?

First and foremost, you may be mandated to pay certain bills with money orders. Property management companies who are lagging behind in tech may not have a payment portal and may require payment by check or money order, or sometimes only money order.

They aren’t always mandatory, but money orders have other benefits.

Money orders are safer than cash in most circumstances. You can track them and cancel them whenever you please, so if they get lost in the mail or somewhere else, you can bring your receipt back to the original purchase location and cancel it for a refund or replace it right away.

Replacing a money order might run you another fee, though, so be don’t go out of your way to lose any money orders.

In general, you want to use money orders for more serious transactions, such as

- Sending money to a relative in a foreign country

- Large payments by mail

- Court-appointed payments

- Rent payments if landlord has no online portal (check suffice, but money orders are more secure)

Where Can I Get A Money Order?

Money orders are available at several places you visit on a regular basis. You can grab a money order from

- Banks/credit unions – Fees are often highest here around $5 per money order.

- US Post Office – Much cheaper than banks, except for international money orders.

- Up to $500: $1.25 per money order

- $501 – $1,000: $1.70 per money order

- International money orders up to $700: $9.50 per money order

- Military money orders: Only $0.45 per money order.

- Stores – You can buy money orders from most grocery stores, drug stores, convenience stores, and gas stations.

- Check cashing companies – No check cashing company worth its salt would refuse selling money orders.

Filling Out Your Money Order Step by Step

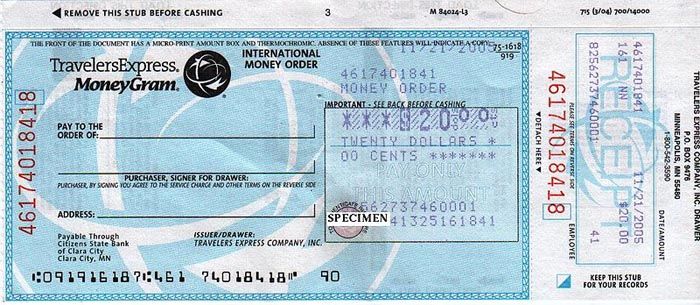

Step 1: Adding The Recipient

First is the recipients name, aka the person you’re paying via the money order. Write the name of the person/business you’re paying on the “Pay to the Order Of” line.

This ensures that only the payee you listed can cash the check, eliminating the risk that someone steals your money or worse, your identity. With that in mind, fill in this section as soon as you get the money order in case you have to finish filling it out later. That way, there’s no chance someone of ill-intentions will get their hands on it.

Step 2: Including the Purchaser’s Address

You’re buying the money order, so write your address in this area. The payee will know how to contact you by mail in case something goes wrong.

Step 3: Provide Further Information if Needed

If you’re paying a bill, find a money order with an “account number” or “payment for” section. This helps the payee credit you for paying your bill.

Use the memo line to elaborate on the purpose of the money order. Be as detailed yet concise as possible. The less ambiguity on an official document involving money transfers, the better.

Step 4: Sign the Money Order

Not much to be said here. Just put your signature on that line to finish filling out your money order. It’s not official until your chicken scratch is sitting on this line.

Similar to a personal check, don’t sign the back. That’s for the payee to sign before they cash the check.

Step 5: Wait! Hold On to Your Receipt

Don’t toss the receipt!

Your receipt bulletproofs your money. If the money order gets the lost, you can use your receipt as proof of purchase in order to cancel or replace the money order.

That being said, keep your receipt stored away in a safe place. We’d recommend getting a lockbox and storing money order receipts and other important financial records.

Cashing A Money Order

At some point, you may find yourself on the receiving end of a money order payment, especially if you’re a business owner. That slip of paper doesn’t hold much value to you if you don’t know where to cash it.

Fortunately, you can cash money orders at many the same places you can buy them:

- Banks/credit unions

- 3rd-party services (Western Union is a big one)

- Check-cashing stores

- Convenience stores

- Gas stations

- Grocery stores

Endorse the money order by signing the back of it like you would if cashing a personal check, but only when you arrive at the bank. Bring valid photo ID (driver’s license, passport, military ID, etc.). Finally, they’ll deduct any fees out of the cash you’re entitled to before handing you the final amount.

Keep that cash in a safe place. If cashing at your bank, you may as well deposit it.

Watch Out For Money Order Scams

The more secure a payment method, the less you expect to be scammed by customers. But be on your toes, because money order scams occur more than you think. Common money order scams include:

- Overpayment scam – Scammer buys an item online with a money order worth more than the item, then asks you to refund for the overpaid amount. The money order will be fake, so you’ll be handing the scammer free money.

- Fake buyer scam – Scammer uses a fake money order to pay you for goods you sell them. You’ll discover you can’t cash it, but it’ll be too late because the scammer has your stuff.

- Fake financial emergency scam – Scammer sends you a fake money order, than asks for a partial refund before you can ship items or receive the money order, “allowing you” to keep some of the money for inconvenience.

- Deposit assistance scam – The “I can’t open a bank account so I need you to deposit this bogus money order on my behalf” It’s not your job to help customers handle their money.

To avoid scams, do some of the following:

- Always verify – Check the serial number, contact the payer using the info provided, etc.

- Be wary of urgency or intimidation – Don’t fall for urgency; it’s your business. If the scammer’s using intimidation, contact law enforcement.

- Look for signs of tampering or forgery – Employees at places like Western Union can look for these signs if you aren’t confident in your own ability to do so.

- Keep detailed records – Keep all money orders you receive and receipts for ones you send.

Keep watch for these, and you’ll be able to send and receive money orders with little worry.