Charlie Review – Text Message Budgeting At Your Fingertips

Budgeting tools and apps are cool and helpful, but they don’t fit everyone’s money management style. Some prefer a more direct, “assistant”-style approach to managing their money, yet they might not be able to afford hiring a person to do their money management.

Recently, tech startups have rushed to fill this gap with personal finance chatbot assistants. Charlie, one of these chatbots, aims to help you monitor your finances and teach you better money management skills.

Is it worth using?

Read our full Charlie Review below to see if it can help you manage your money and budget better solely through text messaging.

What is Charlie?

Charlie is a personal finance assistant chatbot created by Charlie Finance Co, a company founded in 2016 by Iliian Georgiev. The company is currently based in San Francisco, CA.

Charlie claims to save its users $80 per week on average; that could be enough to cover your entire utility bill and the some, with barely any work on your part.

What Does Charlie Offer?

Thanks to being a completely text-based chatbot, Charlie has no app to download. You can access Charlie through Facebook Messenger instead. Saves some memory on your phone.

When you first get Charlie, you link any banks accounts you’d like Charlie to work with you on. You can link your credit cards as well. We’d recommend connecting as many of your accounts as possible to offload more of your personal financial management.

But really, how much can a text-based bot with no dedicated app help you manage your money?

More than you think. Charlie does a few things to assist you in managing your money and controlling your financial picture.

Account Monitoring

Charlie monitors your accounts 24/7. By doing so, it can alert you when various events occur. For example, it can let you know if you have a bill coming due, if your checking account is getting low, or if your credit card balance is approaching your limit.

Thanks to Charlie’s selfless vigilance, you can dodge late fees, overdraft fees, reduce interest charges, and more with almost no effort on your part.

Definitely helps Charlie save its users $80 a week.

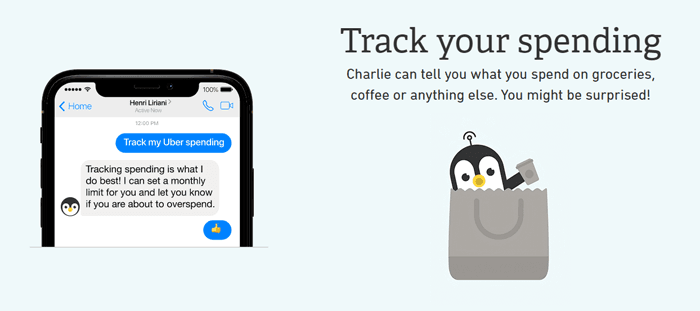

Expense Tracking

Of course Charlie has plenty of expense tracking features. One interesting function Charlie can perform is tracking a specific type of spending. If you wanted to see how much of your cash you’re blowing by going out to lunch every day, ask Charlie to track your restaurant spending.

Find you’re spending too much on that lunch habit? Charlie lets you impose limits on your own spending, enforced by Charlie. Charlie alerts you when you’re approaching your limit.

Not only does this prevent you from mindlessly blowing through your budget, but it instills financial restraint in you, which will help you make better money decisions going forward.

In addition to these unique features, you can view a dashboard of this month’s spending vs. last month’s spending using Charlie’s dashboard feature.

Savings Calculator

Looking to buy a new car soon? Maybe you’re planning an extravagant honeymoon?

Charlie has a built-in savings calculator that’ll help you plan for these and other larger financial events.

You can first set a goal date and amount. Charlie can then display your weekly savings target to hit your goal; it’ll also send you reminders about your savings goal, keeping you motivated until the day of your large purchase finally arrives.

Savings Suggestions

Charlie can even identify ways to save on your recurring bills by looking for lower-cost providers. If it finds one, it will tell you how to sign up for the service to save. Charlie has also partnered with Billshark to help lower some of those pesky bills saving you even more money.

Charlie’s Fees

Thankfully, Charlie is completely free. No fees here, Charlie works for you for free.

Is Charlie Safe?

Your sensitive financial information is safe with Charlie. They use 256-bit SSL encryption, the same level of encryption that banks use to protect your information from malevolent intentions.

When you link your bank account to Charlie, Charlie gets a special passcode that provides it access to read your bank account information, but not to edit anything within the account. It can only read specific documents like bank statements, ensuring it can’t access anything more sensitive.

In addition, Charlie never collects nor does it share any of your personal information.

Long story short, Charlie is safe.

The Verdict

Charlie is a great alternative to traditional budgeting apps that may be more work-intensive to help you save and manage your money.. It’s not very intrusive; it sends you messages regarding your finances, about as intrusive as your friend texting you about something cool that happened to them.

Since it’s free and doesn’t even require an app, basically anybody who has Facebook

Which brings us to the drawbacks.

The first drawback is what we just mentioned: you need a Facebook account. Not everyone is a fan of Facebook, and a lot of people are deleting their accounts. If that’s you, you’ll unfortunately have to wait and see if Charlie expands to other platforms.

The other weakness is Charlie isn’t as comprehensive of a personal finance tool as a traditional budgeting app. That comes with the territory, though; you can only do so much when your entire product is based on Facebook Messenger.

Don’t let any of these minor drawbacks dissuade you from at least trying it: Charlie has an almost perfect 4.8/5 stars on Trustpilot, and several other sites have given it at least 4 stars.

How to Open an Account with Charlie

If you thought signing up for budgeting apps was fast, you’ll be wowed by Charlie.

Before you sign up for Charlie, you’ll need a Facebook account first. Signing up for Facebook easily takes longer than signing up for Charlie.

Have a Facebook account? Simply navigate to Charlie’s website, click the “Sign Up For Free” button, verify that you’d like to log into Messenger as yourself, and then Charlie will send you its opening messages introducing itself.

Then, link any bank and/or credit card accounts you’d like Charlie to monitor.

That’s it!