M1 Finance Review – What You Need To Know

Until recent years, you had to rely solely on a human financial advisor and/or broker to manage your investment portfolio and make trades.

Not anymore with robo-advisors!

Robo-advisors are online financial advisors that require no more than moderate human intervention. They take your investor info (like risk tolerance and other preferences) and use algorithms to make optimal investments.

But not all robo-advisors are simple. Despite their best efforts to simplify investing, some fail at simplifying the complex world of investing so that their users can understand what their money’s doing.

In addition, many robo-advisors only offer the advisor part; the broker part might fall by the wayside.

That’s where M1 Finance comes in.

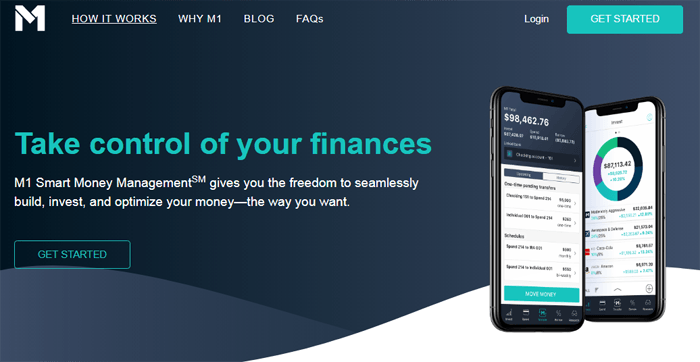

M1 Finance claims their robo-advisor is built with the modern investor in mind. They aim to minimize the difficulty of portfolio management so you can spend less time on your investments and still get great returns.

But do they deliver on their promises?

Read the rest of our review to find out.

M1 Finance’s Features And Strengths

Automatic Investing

Like other robo-advisors, M1 Finance has automatic investing.

So why is it better than any of it’s competitors in investment automation.

The next section tells all…

Pie-Folios And Rebalancing

M1 Finance’s most noteworthy feature is it’s love of pies.

Allow us to explain.

When you sign up for an M1 Finance account, you’re asked a series of questions about your risk tolerance and your investing goals, similar to other robo-advisors.

After you’ve handed M1 your investor profile information, it will present you with a pie chart consisting of a preselected portfolio suited to the information you gave them.

Each slice represents one asset within the portfolio.

That’s not your only option: you can choose from one of M1 Finance’s other prebuilt and expert pies. Some of these include

- Retirement: Set a retirement date and the pie will know what to do

- Income investments: If you enjoy dividends and similar investment income, there’s a pie for that.

- Industry-based: For people who are highly interested in certain industries, such as tech.

- Hedge funds: The experts know best. This will create pies based on the portfolios of prolific investors like Warren Buffet.

If none of those interest you, you can even change up the weights in the prebuilt portfolio to suit your exact tastes.

However, that’s not the end of the cool pie feature.

Once you fund your pie, the money will automatically flow into each asset based on the proportions you set.

For example, if your invested $100 into your pie that consists of 50% Apple 50% Microsoft, M1 automatically sticks $50 in each stock.

But wait. There’s more!

As your investments change in value, they’ll accommodate more or less of the pie: slices outperforming their target weights grow, while slices underperforming shrink.

Every time you invest more money into your portfolio, however, the pie buys and sells shares automatically to realign each slice with it’s proper weight.

In other words, M1 Finance offers automatic rebalancing.

Other apps like Stash or Acorns let you set up an automatic deposit every month that you can then invest manually in any asset either platform offers.

But while automatic investing is a basic feature every robo-advisor has, M1 takes it a step further with automatic rebalancing to create a true “hands-off” investment experience if that’s what you want.

Just set the regular investment amount, set your pie slice weights, and you never have to look at your portfolio again (in theory).

However, they don’t lock you out of making adjustments. You can change the weight of each slice to your liking; you can add or drop slices as well.

On top of all that, the pies really help investors visualize their portfolios. This can bring great peace of mind.

No Commissions And Barely Any Fees

Every advisor has to eat. Even most robo-advisors take a small cut of your investments.

But M1 Finance charges you absolutely nothing to make trades on your account no matter what kind of pie you’ve built.

They used to do so, but hey: they’re investor-minded.

Trading fees didn’t earn them much money and made it just a bit less accessible than it could’ve been, so they did away with all trading fees in 2017.

As for other fees, they do charge an $100 termination fee. That’s pretty standard among brokers, though.

They also charge an activity fee if you do both of the following:

- Keep less than $20 in your account, AND

- Remain inactive for at least 90 days

M1 also charges for irregular investor fees that involve services beyond the scope of the platform.

We don’t think a lot of people are ending their M1 use, nor do we think they have a lot of inactive users.

So how do they make their money?

They actually operate almost exactly like a bank: they lend out your cash and securities in order to earn interest.

M1 also offers margin loans; with margin loans, M1 lends you money so you have additional investing power. You then pay them interest.

Multiple Account Types

M1 goes so far as to offer 4 types of accounts to serve a variety of investors:

- Individual – Your typical taxable account for individuals.

- Joint – Combine your investments with a sibling, spouse, or relative to invest more money and reap more gains.

- Retirement – Everyone retires at some point. M1 finance offers traditional, Roth, and SEP IRAs for those interested in saving for retirement.

- Trust – Want to bestow your assets upon someone else someday? M1 has trust accounts.

No Account-Opening Minimum

Technically, you need a minimum of $100 for normal taxable accounts and $500 for retirement accounts to invest in your first pie. That’s a pretty low initial investment, but even that doesn’t preclude you from at least opening your account.

You can always open an account now and come back when you have the money to invest. If you sign up M1 Finance will even give you a free $10 bonus which will allow you to grab a free stock (if it is cheap enough).

M1 Finance’s Weaknesses

No Tax-Loss Harvesting

Although everyone hates the IRS, they aren’t completely bad.

Namely, they let you write off losses on many types of investments, usually in taxable accounts (no tax advice here, just common knowledge).

Many robo-advisors do this for you if they detect you could use any losses to offset any gains in your investments to reduce your taxable income.

Unfortunately, M1 Finance’s biggest drawback is that it doesn’t harvest your tax losses.

But when you look at the way their system works, a lot of pies would be thrown out of whack if M1 Finance just sold anything that could be written off as a loss on taxes.

That’s the price you pay for the convenience of automatic rebalancing.

No 401(k) Plans

Sure, M1 Finance offers a few types of IRA accounts. However, they don’t seem to support the notorious 401(k) account.

It’s not a fatal flaw for the platform, but it’d be nice if they could expand their offerings in the near future.

No Mutual Funds

M1 Finance has a lot of choice when it comes to investment options, but mutual funds are sadly not one of them.

Similar to the 401(k) issue, this isn’t a crippling problem unless you’re extremely in to mutual funds. We would recommend low cost ETFs anyways.

The Verdict

We’d recommend M1 Finance to two types of people:

- Passive investors – If you have extra money and want your investing to be a very hands-off experience, the combination of automatic investing and automatic pie rebalancing fits this goal perfectly.

- New investors that want to learn the stock market – These people should rely on M1 Finance less for their life’s savings and more for learning the market with a small bit of money at stake. After all, the best way to learn is by doing!

With little to no fees, all the automation features, and their intuitive interface, M1 Finance is overall a great robo-advisor if you don’t care about maximizing your tax-loss writeoffs.

How To Get Started With M1 Finance

The great thing about M1 Finance is you don’t need to transfer a cent into your account until you want to actually find your pie.

Here’s how to get started with M1 Finance.

First, navigate to their website and click the signup button. You’ll give them your email and create a password here.

Then, you give them your basic personal information that any broker/bank/advisor requires of you.

From there, give them your investor information; as we said earlier, you should be greeted with some pie options after M1 runs it’s calculations.

Pick your pie and you’re done!

Of course, you’ll want to link your bank too if you want to take advantage of automatic investing and automatic rebalancing.