Zebit Review – Purchasing Items With Installments and ZERO Fees

Interest is considered the “cost” of borrowing money. In other words, you can “buy” extra money by paying interest.

But since you have to return the money eventually, interest is basically a furnace that you shovel your cash into whenever you borrow.

Unfortunately, unless you borrow from a close friend or family member, there’s little chance you’re getting away without paying interest.

Making matters worse is credit score. With little or poor credit history, you’ll have a harder time securing good interest rates (let alone any debt at all). Your higher interest rate will be harder to pay, potentially hurting your credit even more.

The founders of Zebit took issue with this, as well as with the complicated “financialese” accompanying any form of debt you take out.

What is Zebit?

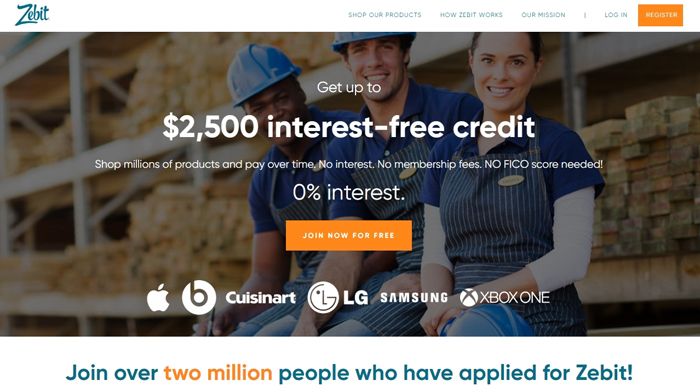

Zebit is a platform that lets you make large purchases online in installments. It was founded in 2014 by Michael Thiemann and Marc Schneider.

They aim to make it easy for those without much money and/or bad credit obtain inexpensive financing for large purchases.

To do so, they offer the ability to shop online using an interest-free, fee-free credit line. Zebit users can then purchase high-ticket items and pay for them in installments. No credit checks, no interest, none of that.

Thus, accessible and affordable financing for those without a lot of cash or credit history.

Zebit’s Features

Zebit offers up to $2,500 in interest free credit to each of its users. Zebit buys items at wholesale prices then resells them to the users, who use their interest-free line of credit to pay for it installments.

You might pay more in total for the item due to the markup (hey, Zebit has to make money somehow), but you don’t have to front the entire purchase price if you don’t have enough saved up, nor do you have to risk incurring interest charges.

Zebit has tons of cool features, too.

ZebitLine

Your interest-free, fee-free credit line is called your ZebitLine. You can use your ZebitLine to purchase products from the Zebit Market (more on that in a minute) on an installment basis. For most items you purchase with your ZebitLine, you put down a down payment then get 6 months to pay the rest of the item off.

Your ZebitLine can’t be used anywhere but on the Zebit Market for obvious reasons.

Zebit can award you up to $2,500 in ZebitLine credit. The actual amount you initially receive likely depends on your income level or employment information you provide them. However, as you build up a payment history with them, they’ll reevaluate and potentially extend you more credit (similar to building a credit score).

Speaking of that payment history, Zebit lets you set all your payments to auto pay, guaranteeing you’ll pay everything on time as long as you have the funds.

Currently, one of Zebit’s main drawbacks is you have to apply for a new ZebitLine if you move employers. Not a huge deal, as you can just apply for a new one. Still, Zebit is working to allow employees to keep their ZebitLines if they get hired by a new employer.

Zebit Market

The Zebit Market is where you can purchase items with your ZebitLine, credit card, or debit card, all interest-free (except for your credit card’s interest rate, of course). If you use your credit or debit card, you have to pay full price up front. Using your ZebitLine gets you the installment deal.

Zebit is always updating the items for sale on the Zebit Market. Most items are new. Any used or refurbished items will be explicitly marked as so for your convenience.

With those things in mind, there are several categories you can browse through:

- Accessories

- Appliances

- Computers

- Electronics

- Furniture

- Health equipment

- Home goods

- Kitchenware

Once you select an item for purchase, Zebit shows you the full price if you’re paying with your linked card or the installment payment amounts and their frequency if you’re paying with your ZebitLine.

ZebitLine Payments won’t always be equal each month, so check the payment schedule when you choose the item to confirm you’re ok with it.

Also, you can pay off items purchased on Zebit early if you desire. You won’t benefit from reduced interest payments, but it’s one less thing to worry about.

Unfortunately, Zebit does not report your successful ZebitLine payments to the credit bureaus, so Zebit purchases are not a method for building your credit score.

ZebitScore

ZebitScore’s name is a bit misleading. You might think it’s Zebit’s “credit score” measuring your payment history, but it’s actually a free general financial health tool that finds personalized topics and suggestions for improving your money situation.

To get your current ZebitScore, you first run through an 11-question survey asking you about things like your income, debt levels, retirement investing activities, and your general feelings about your financial life

At the end, you’ll receive your score. Zebit will tell you your financial strengths and weaknesses, then show you some learning resources where you can read up on topics most relevant to your financial life.

An overall neat tool to accompany Zebit’s philosophy of democratizing financing.

Zebit’s Fees

At this point, you might think that Zebit has to charge some fees to make their money.

But they in fact do not charge fees in the same spirit as their interest-free policy. Per several sections on their website, there are no catches at all.

What If I Miss a Payment?

On occasion, you might purchase an item and plan to pay it off in installments, only to come up short on your monthly payment a few months in.

Zebit does their best to help their customers, because they know finances can get tight at times.

If you’re unable to make a payment, Zebit won’t charge you interest, of course. Instead, they’ll simply freeze your account and ask for another form of payment. You won’t be able to make any purchases until you come up with the money for the payment, but it’s much better than incurring late fees, interest charges, and taking a credit hit.

Once you can afford to make the payment again, they’ll unfreeze your account so you can resume your normal Zebit activity.

The Verdict

There really is no catch with Zebit, unless you count paying a little more for items than Zebit paid for them a catch. But that’s how Zebit makes money anyways, so you can’t fault them for it.

Overall, it’s excellent for you if you’re in a tight monetary situation or have little credit but need to buy a high ticket item.

However, even those who have a bit of discretionary income or decent credit will find Zebit a viable method of acquiring high-ticket items if they don’t currently have the funds to pay up front and/or they’re sick of interest.

That being said, you won’t derive a whole lot of value from Zebit after you reach a certain level of wealth. It’s worth looking into, but at some point, $2,500 in credit won’t be enough for you to access more expensive items that you’ll want with your upgraded lifestyle

How to Open a Zebit Account

In order to join Zebit, you must meet the following requirements:

- 18 years of age or older

- Actively employed, retired, or disabled with benefits

If you meet those requirements Joining Zebit is easy. They’ll ask for your Social Security number to validate your identity; Zebit will also need some proof of employment/retirement/disabled benefits.

No credit score is required; they validate your information without doing a hard inquiry through the credit bureaus. Instead, they use a 3rd-party service unaffiliated with FICO that doesn’t count as a traditional hard inquiry on your FICO score, meaning your credit score will be spared.

Once approved, they’ll give you a ZebitLine based on the information you provided them. You’re then free to shop. Just make sure to make your payments on time!

Zebit FAQs

Here are a few questions that you may still be wondering about!

Does Zebit Help Your Credit?

Your Zebit account does not and will not be reflected on your credit report. Because of this, Zebit does not affect your credit score in any way. Zebit has reported that they want to implement credit reporting in the future so that you can use the service to build your credit, but this is not a live feature at the moment.

What Happens If I Don’t Pay Zebit?

If you do not pay Zebit or miss a payment, the company will work with you to pay off anything that you have purchased. Zebit will free the account if a payment is missed and ask you for another form of payment. You will be responsible for the purchase price but noting more than that. They will still not charge any fees if you miss a payment.

How Does Zebit Line Work?

ZebitLine is the amount of credit that you have to finance products through Zebit’s marketplace. This is interest free credit! When you make a purchase, your ZebitLine will decease by the amount of the product that you purchased until it is completely paid off.